Money Market Brief

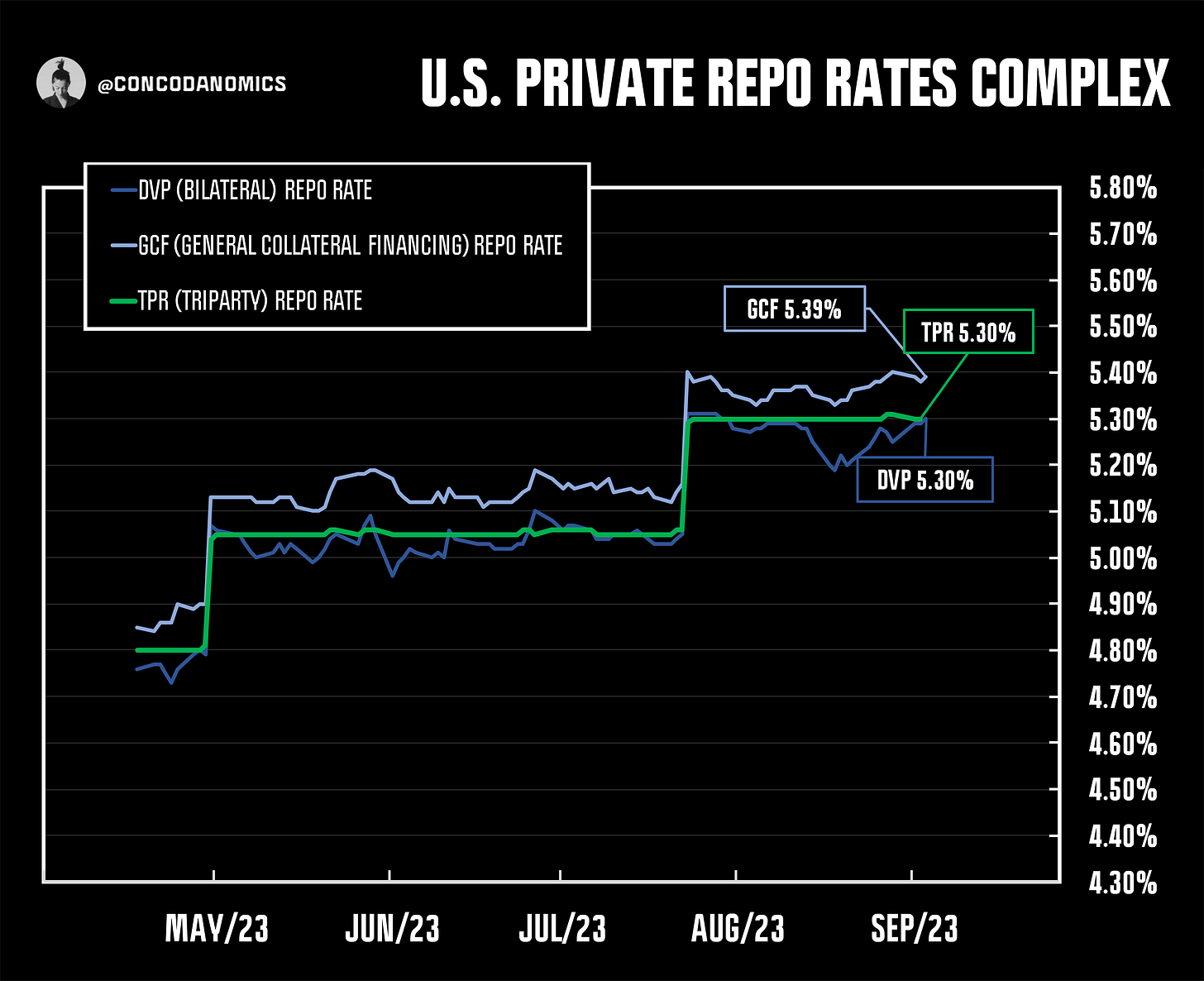

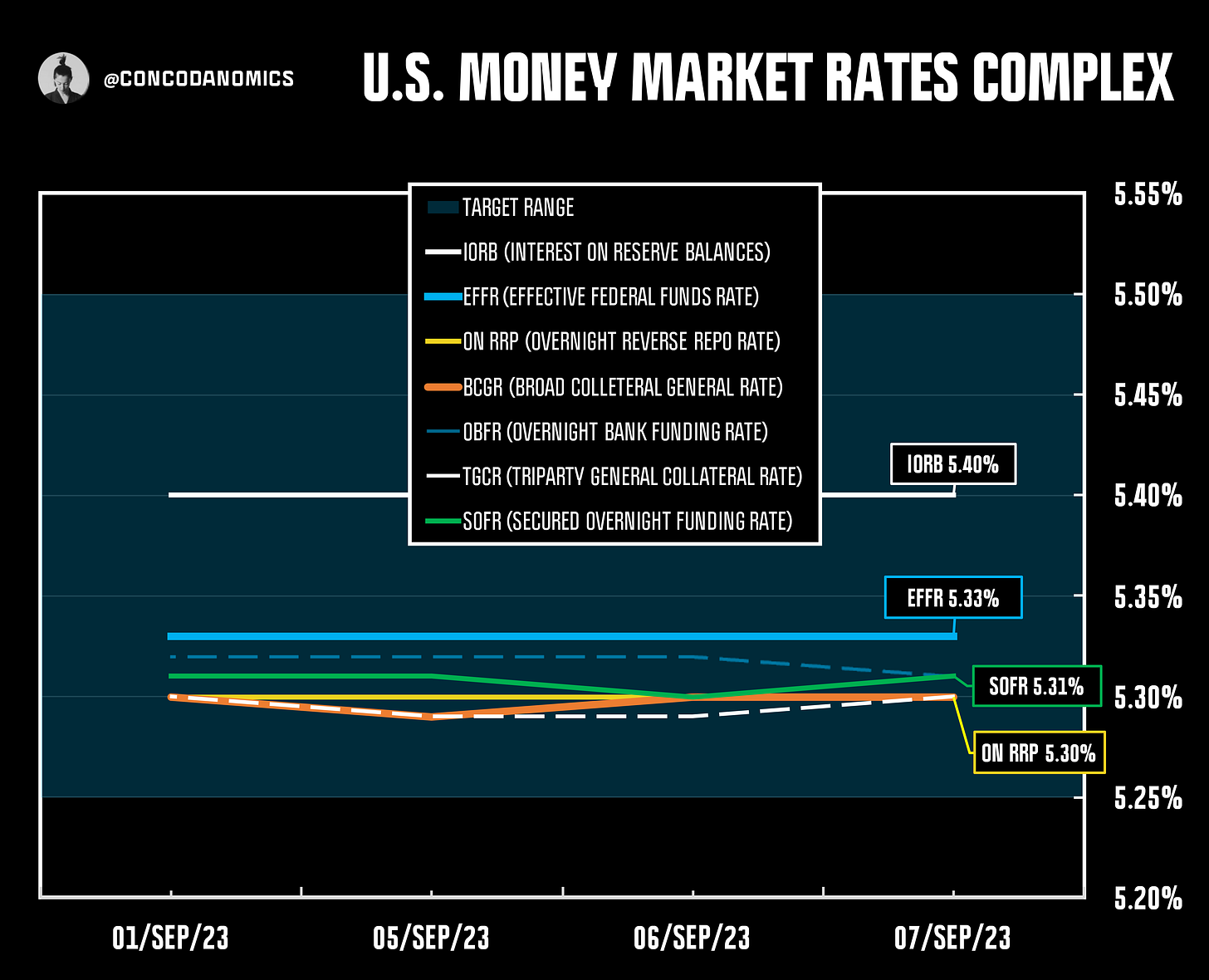

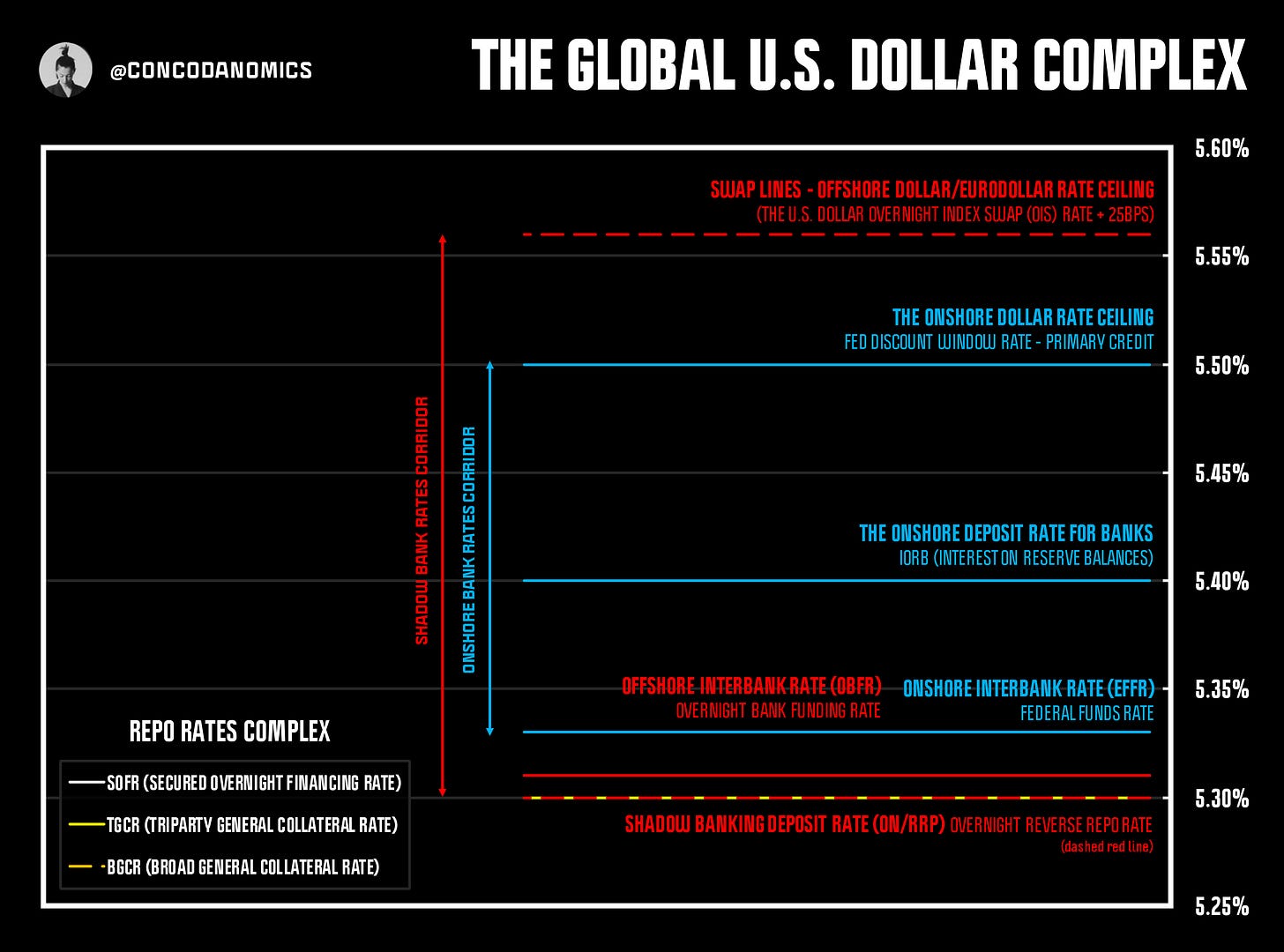

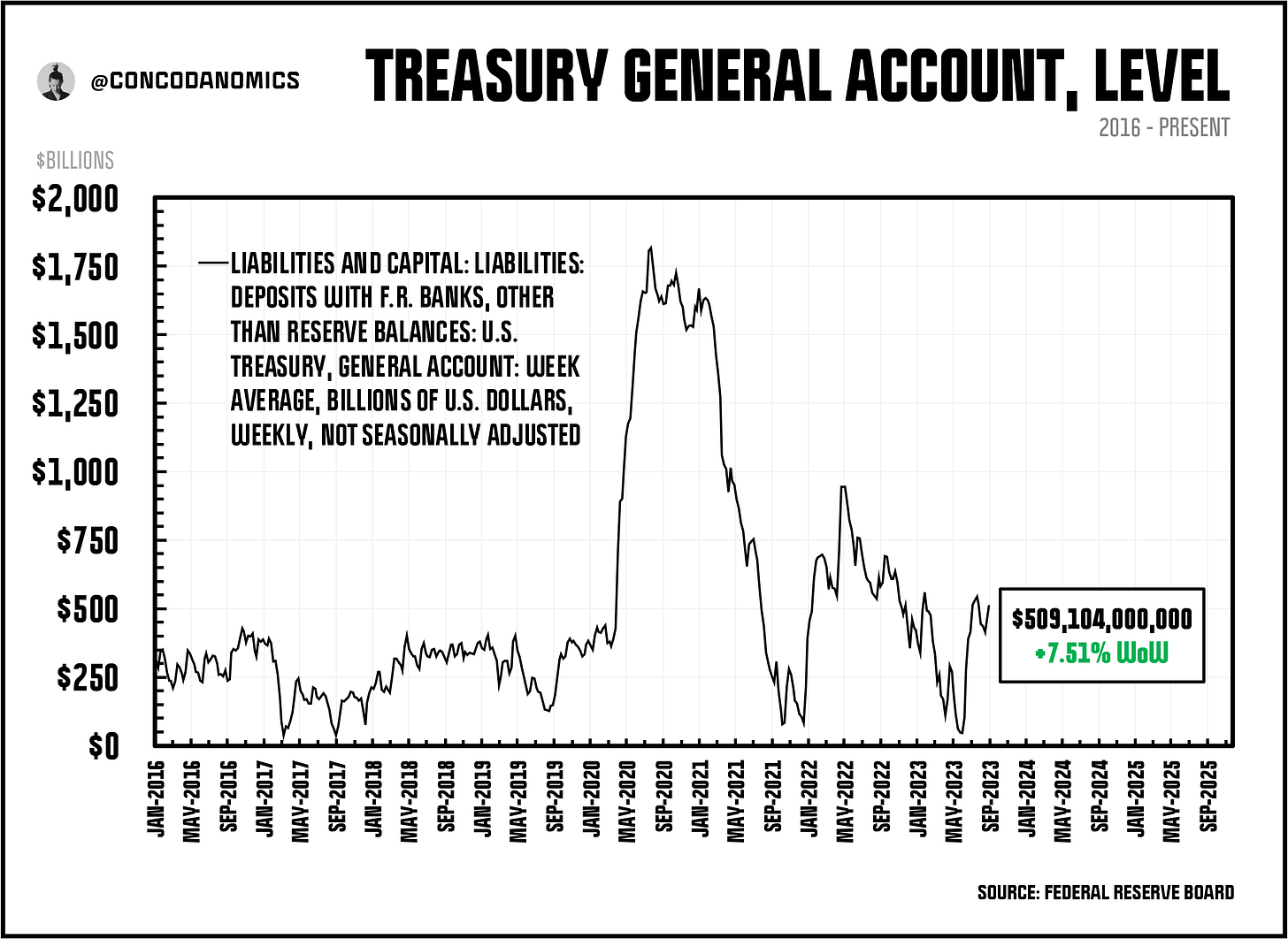

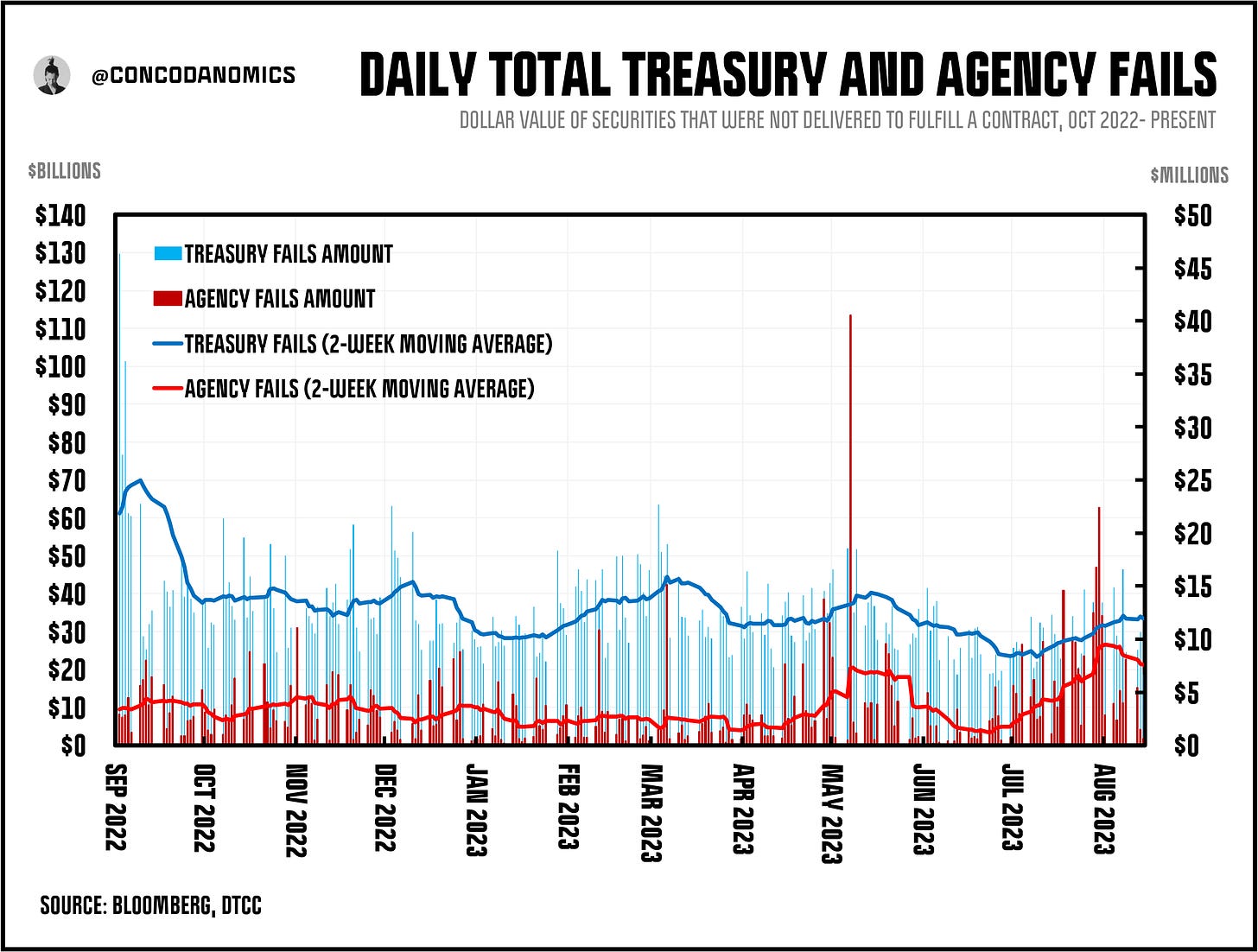

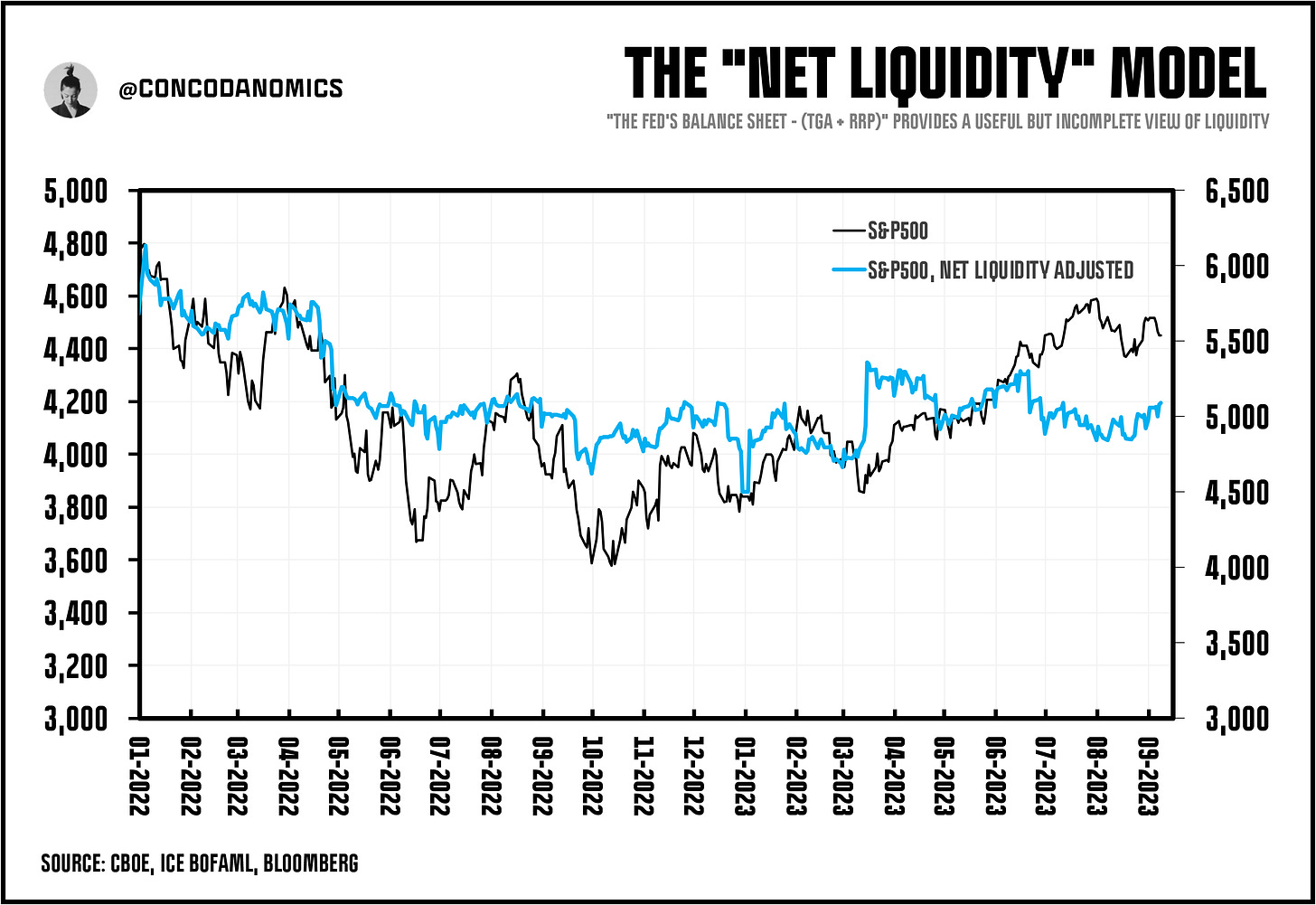

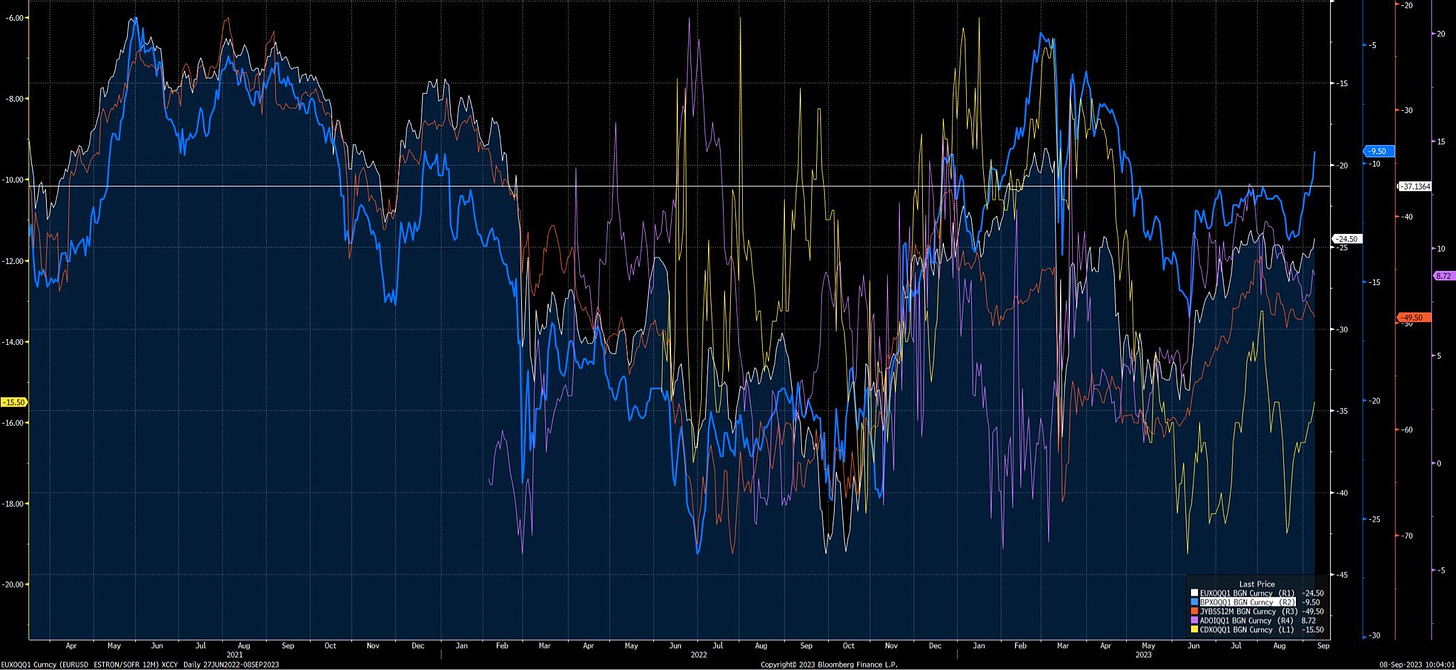

broad repo rates keep overtaking the Fed's risk-free repo rate, ON RRP, indicating that the market is dictating price. RRP cash will thus continue to fund issuance but also more leveraged trades

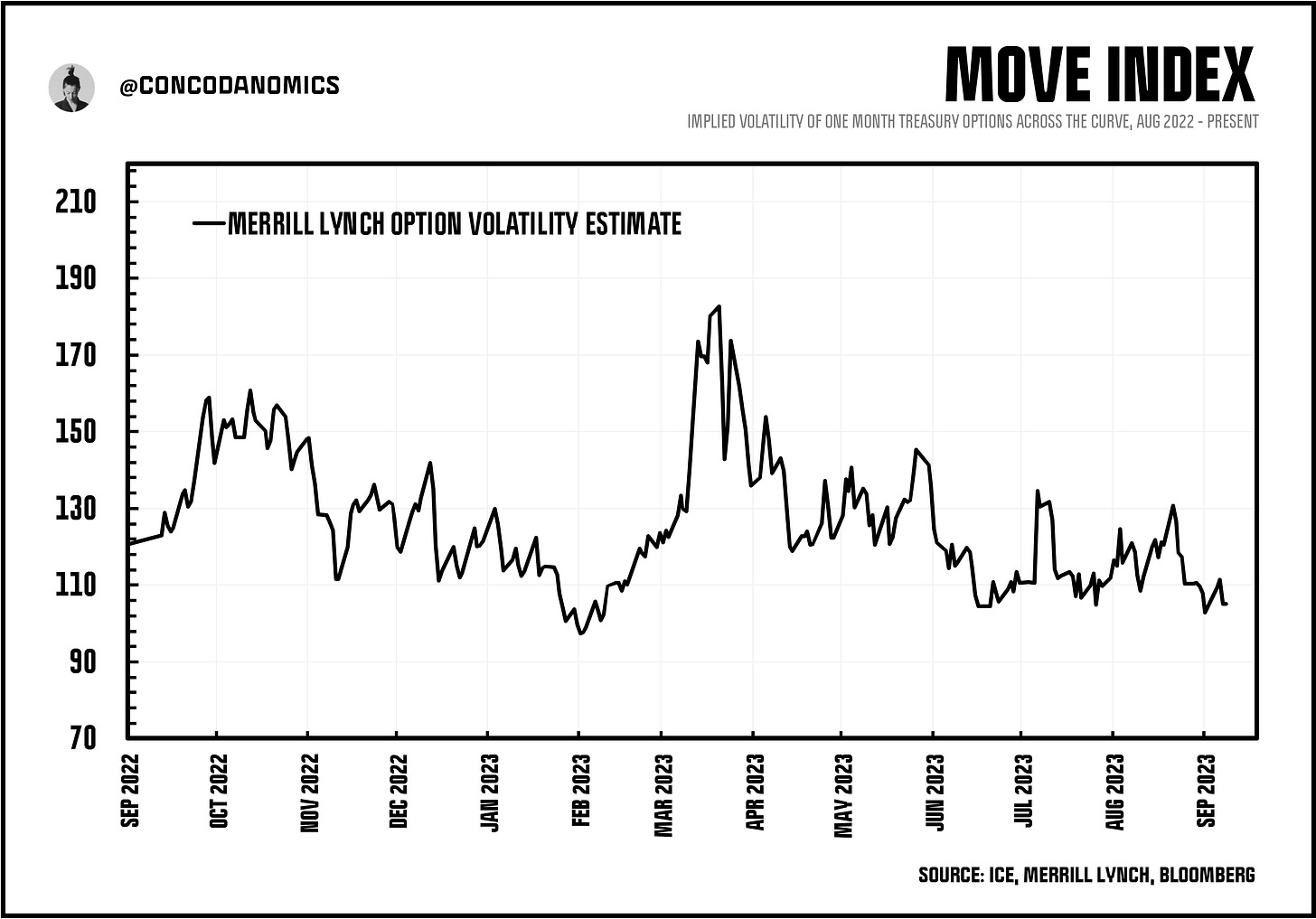

In case you missed it — or you’ve just joined us — our latest piece, The Coming Volatility Suppression, went live earlier this week:

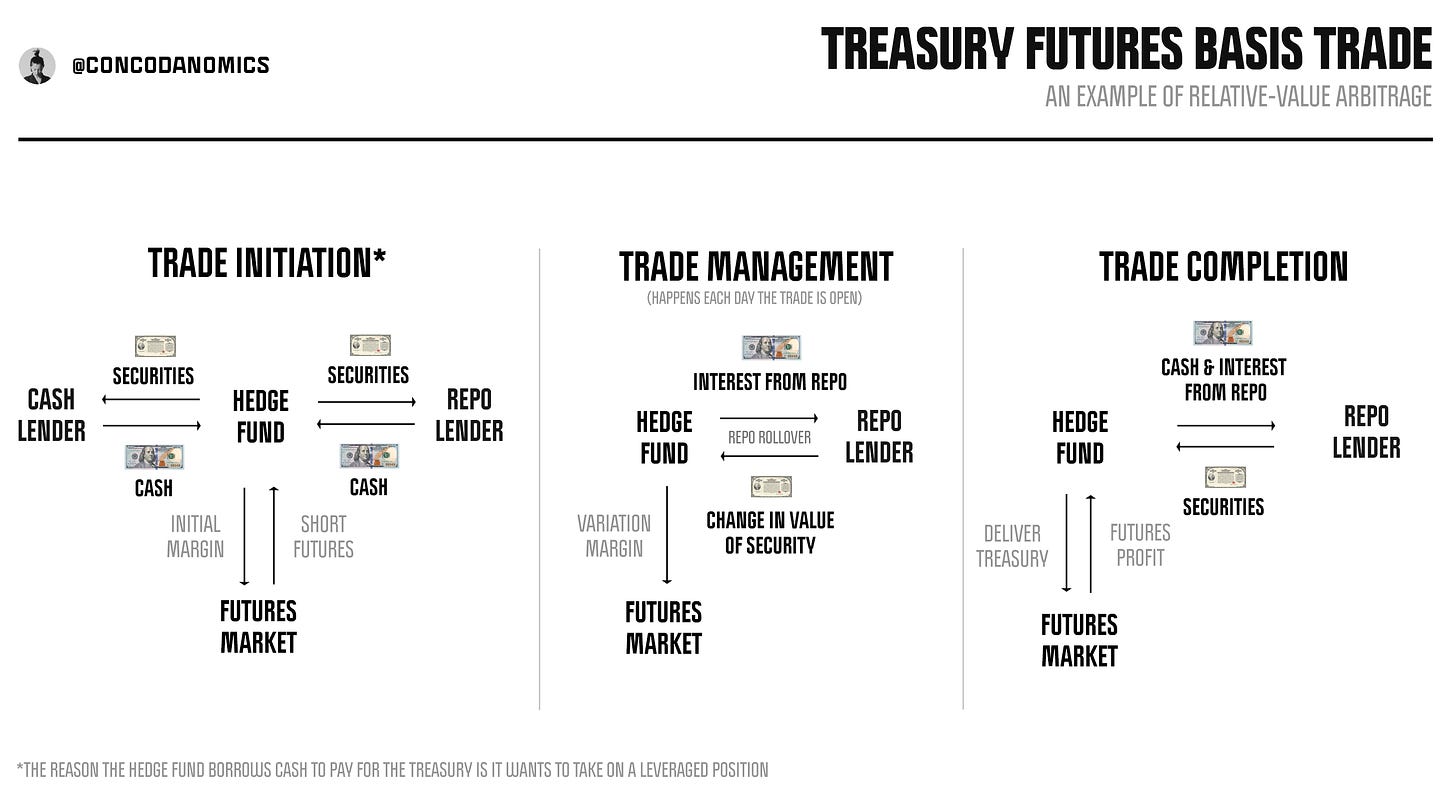

Our forthcoming article will examine the re-emergence of a notorious trade in the U.S. Treasury market. Then, in the next of our subscriber primers, we’ll demystify the interbank FX market. But first, a money market brief…

(the below article provides a recap on RRP mechanics…)

How is collateral typically borrowed/arranged for OTC non-cleared repo loans?

To your knowledge does EquiLend play a role in making collateral available for repo?

I’m trying to get to the bottom of this question, but run into walls. Thank you!