Money Market Brief

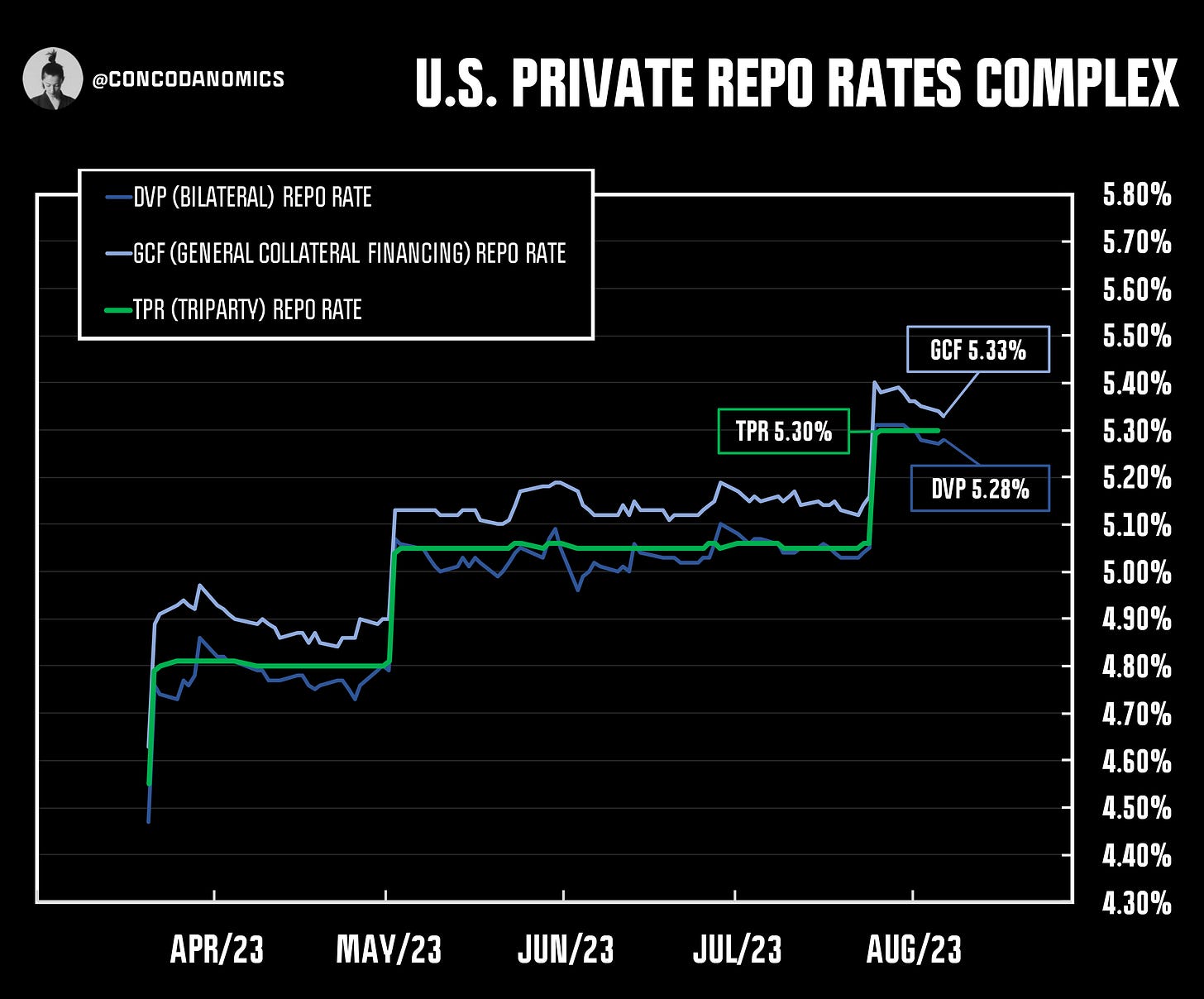

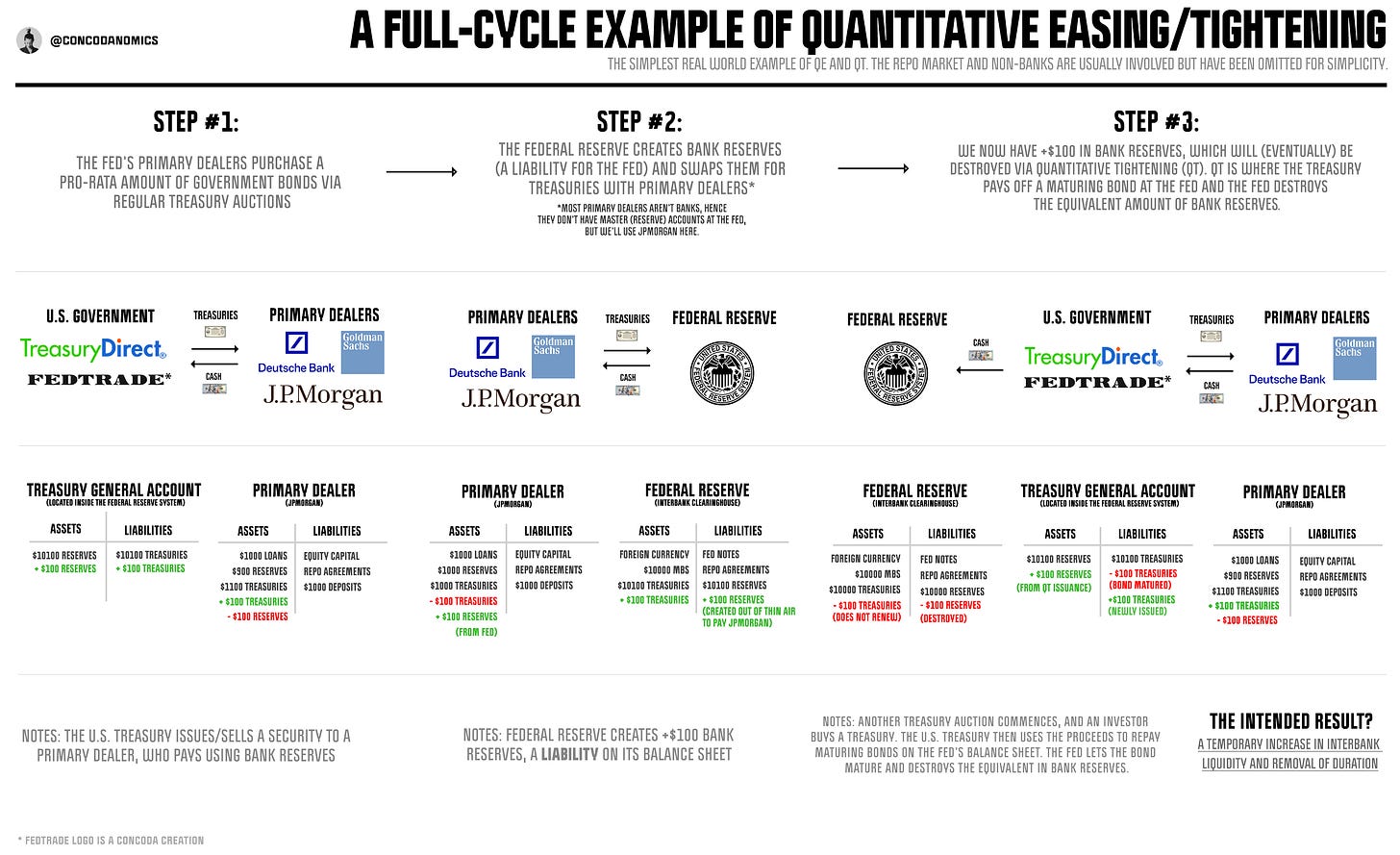

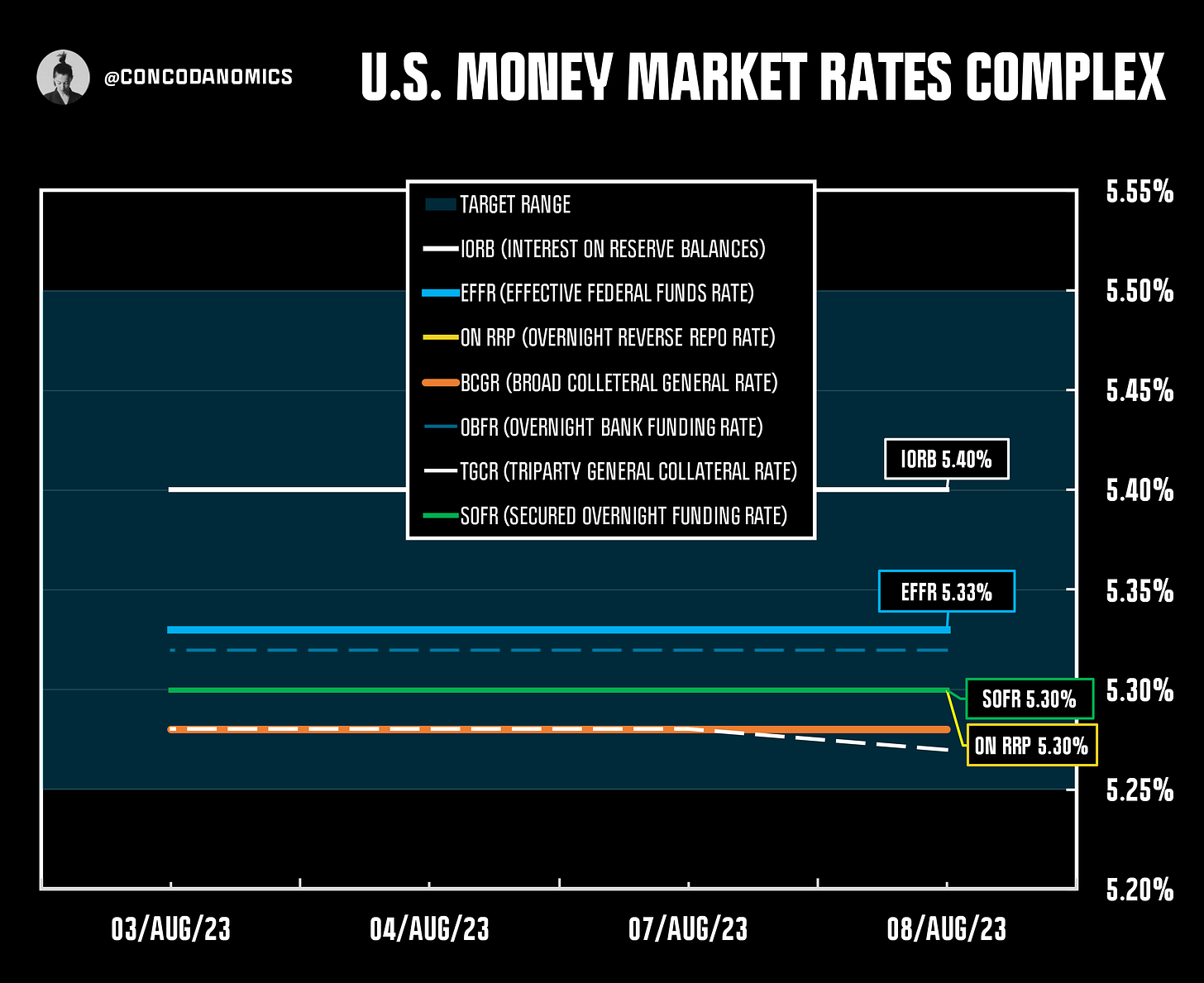

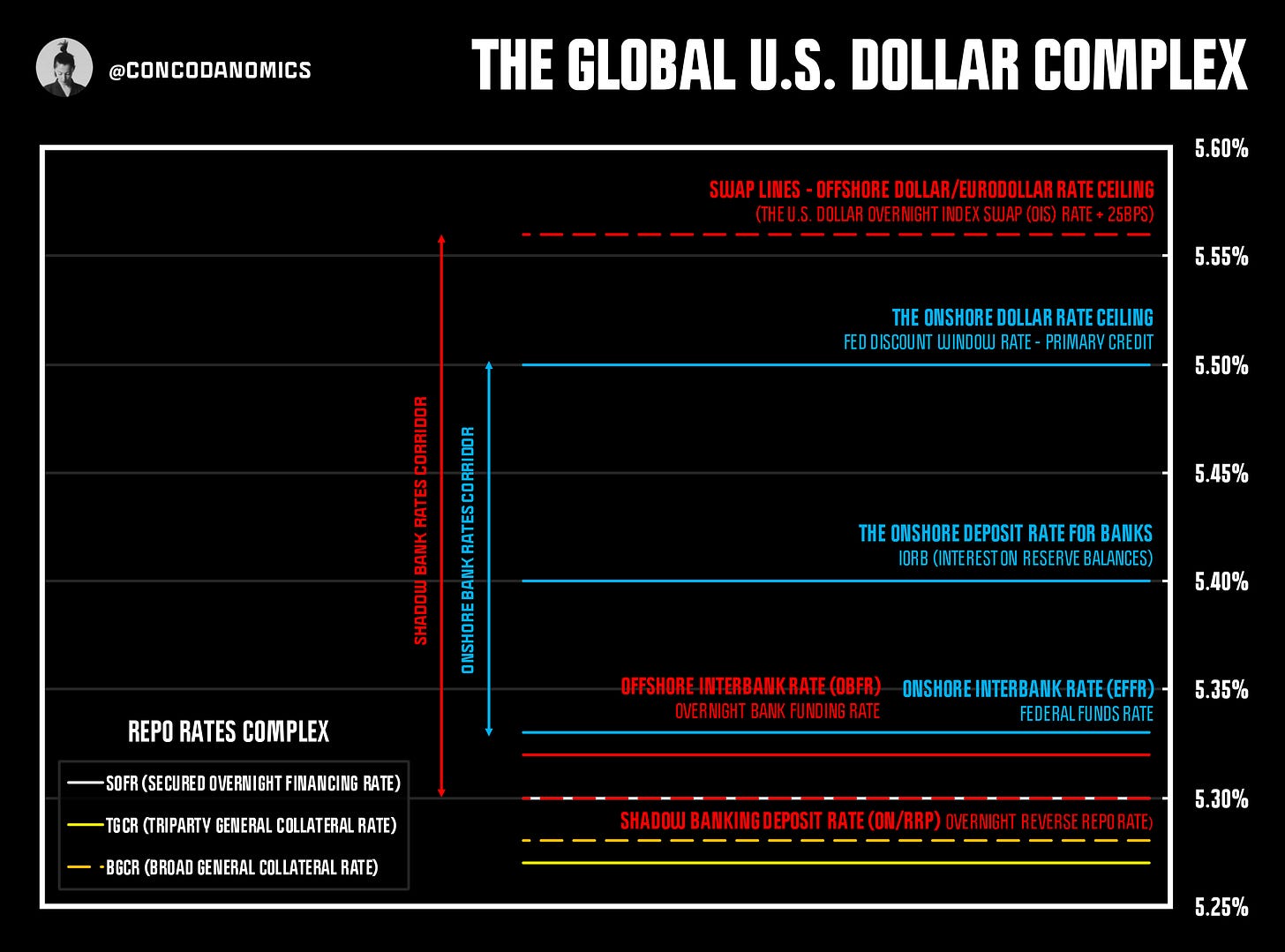

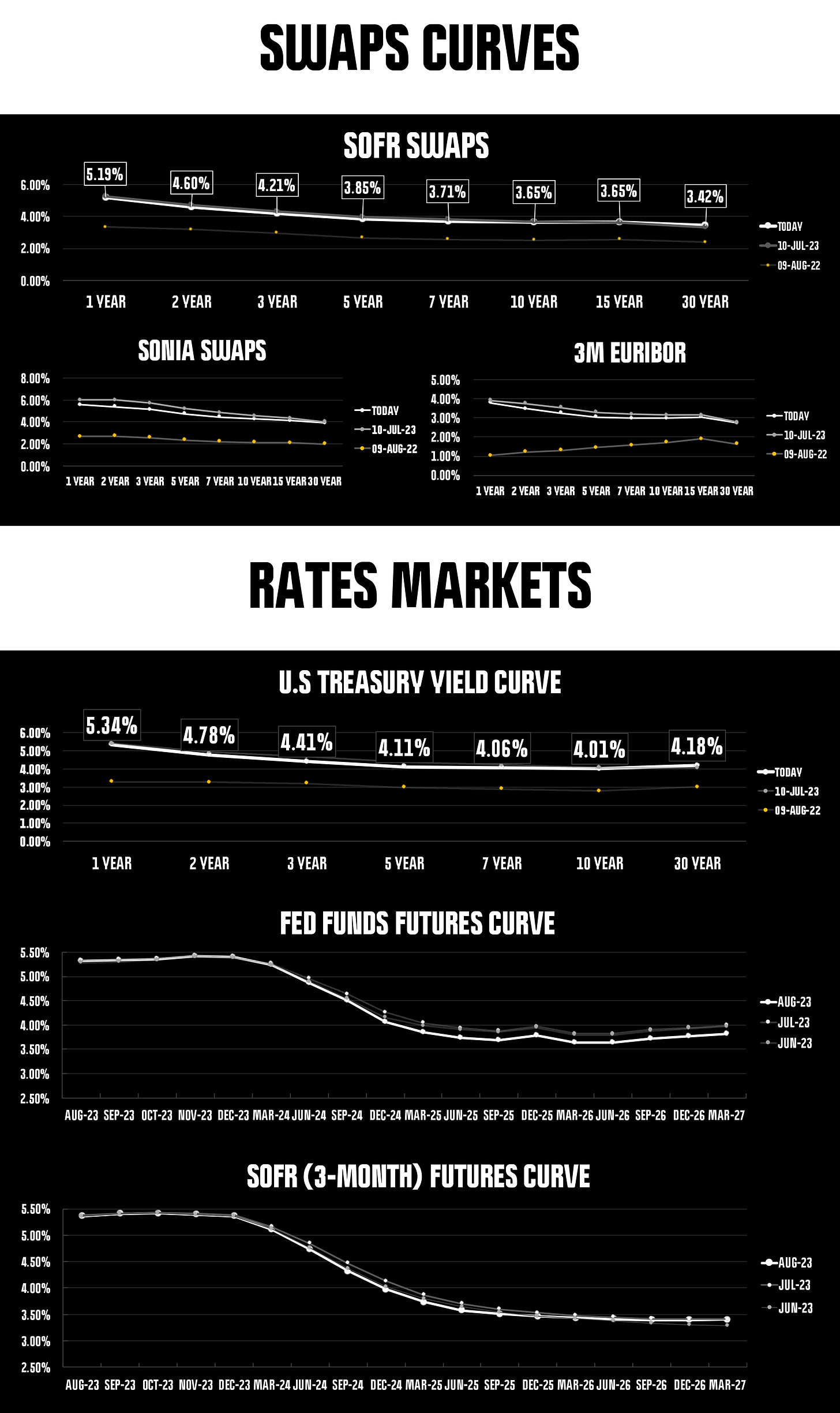

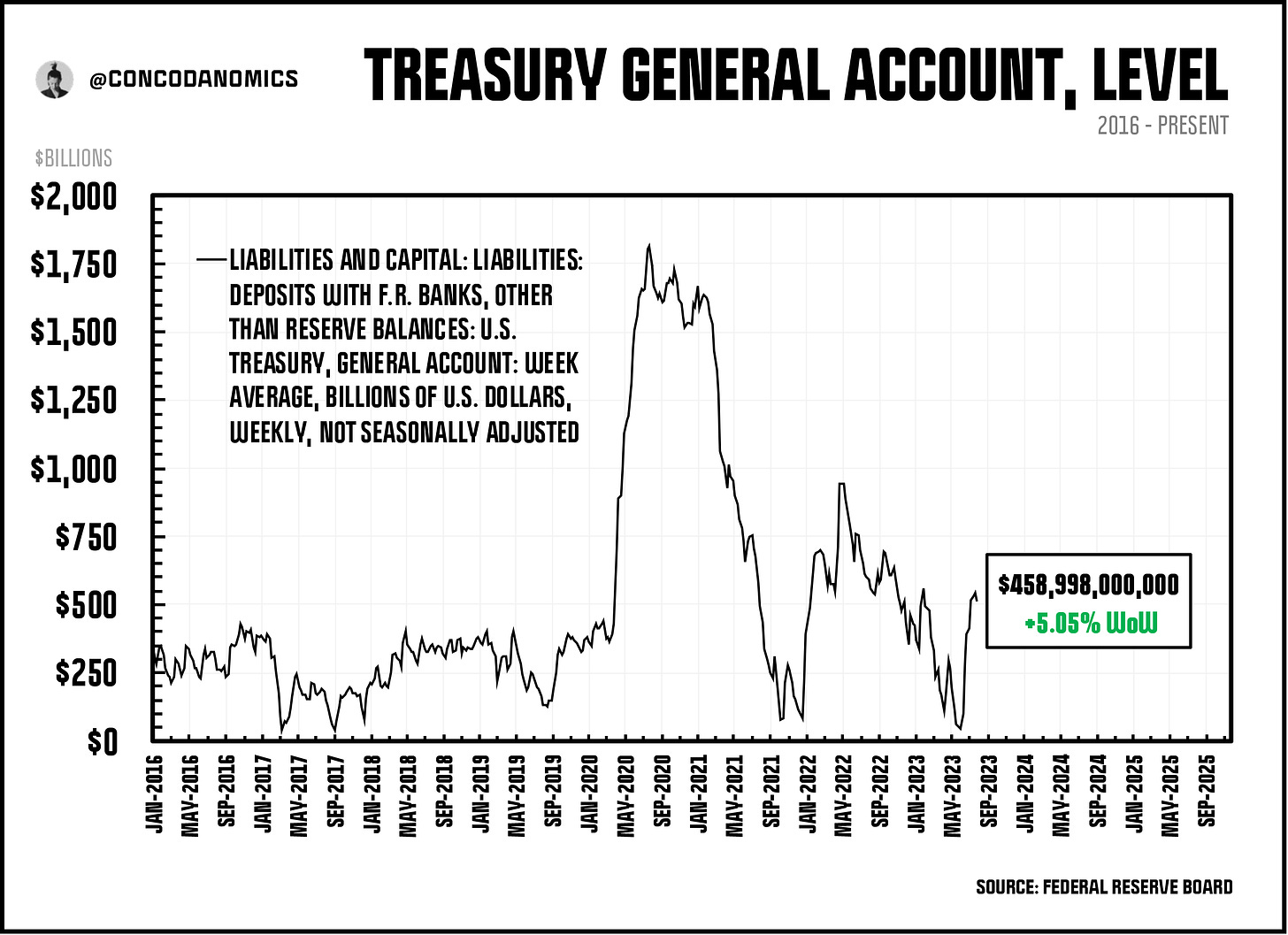

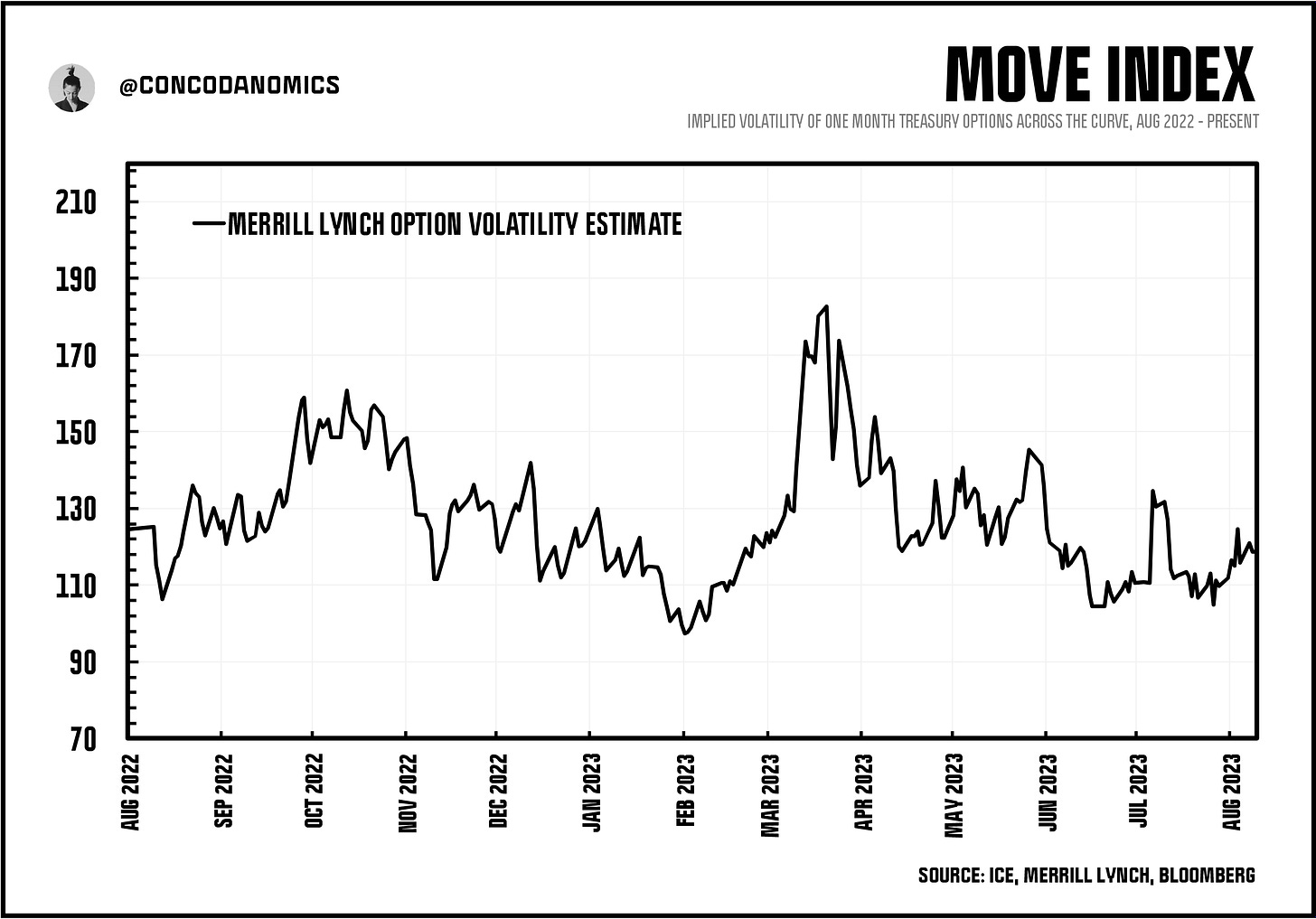

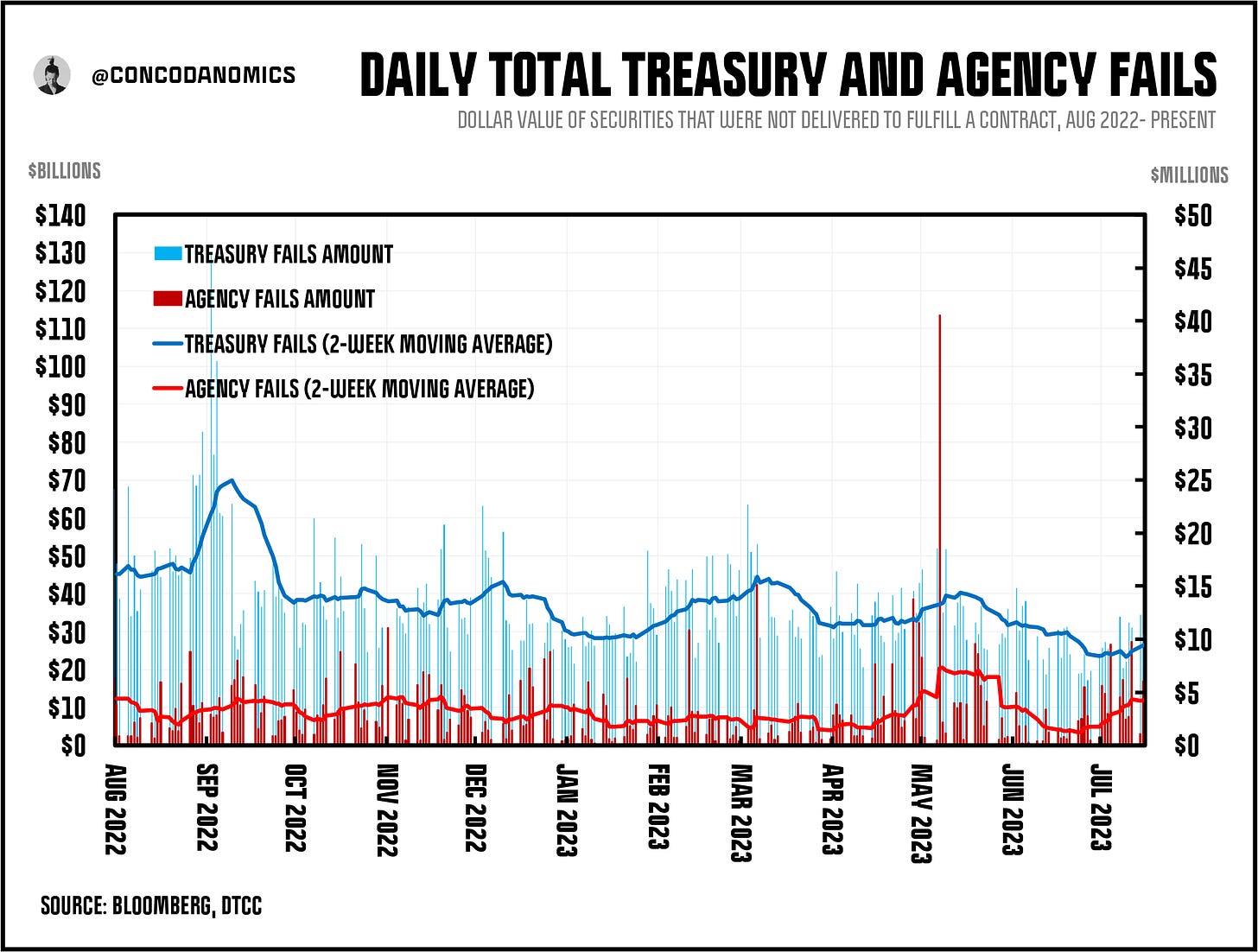

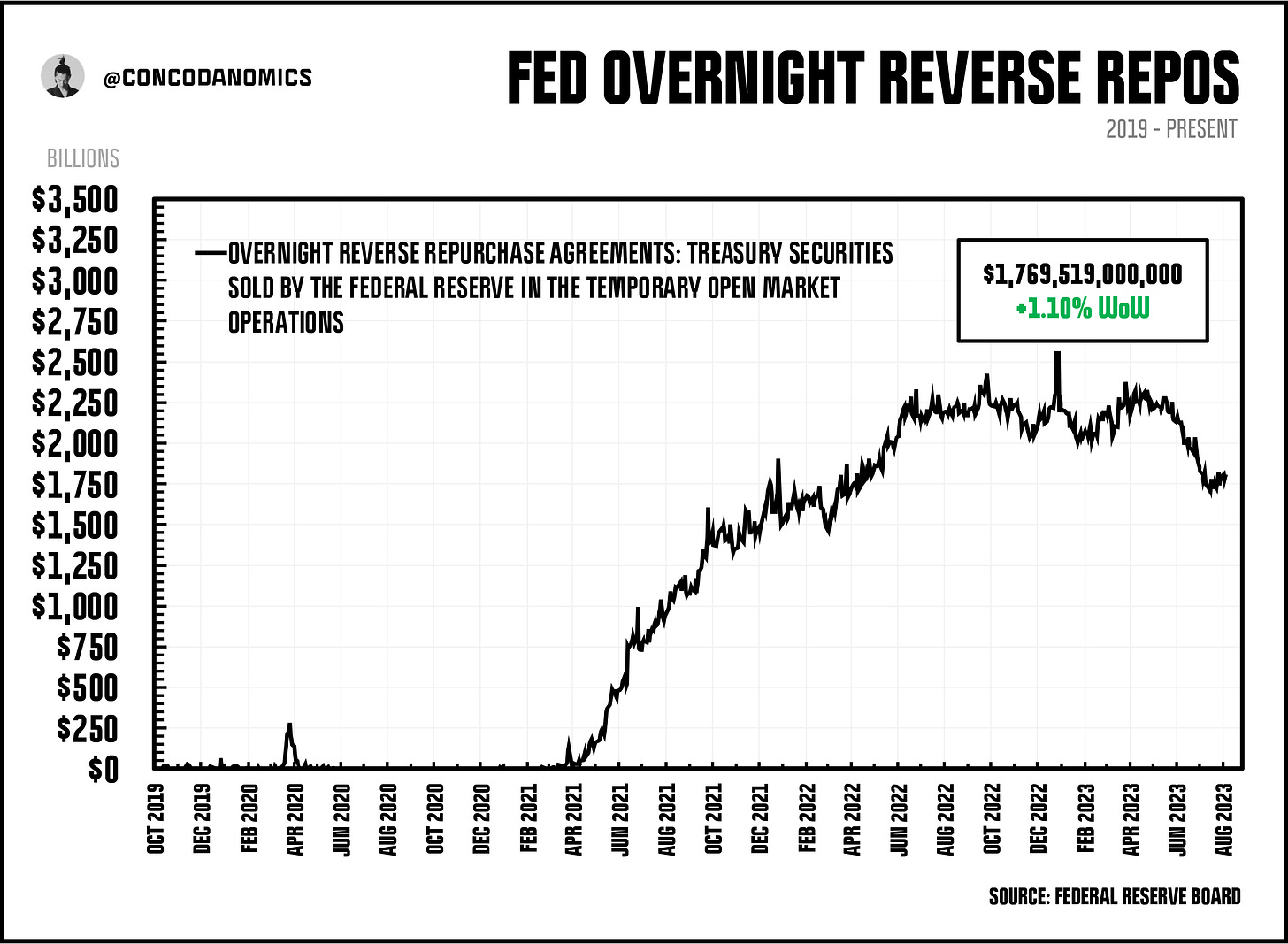

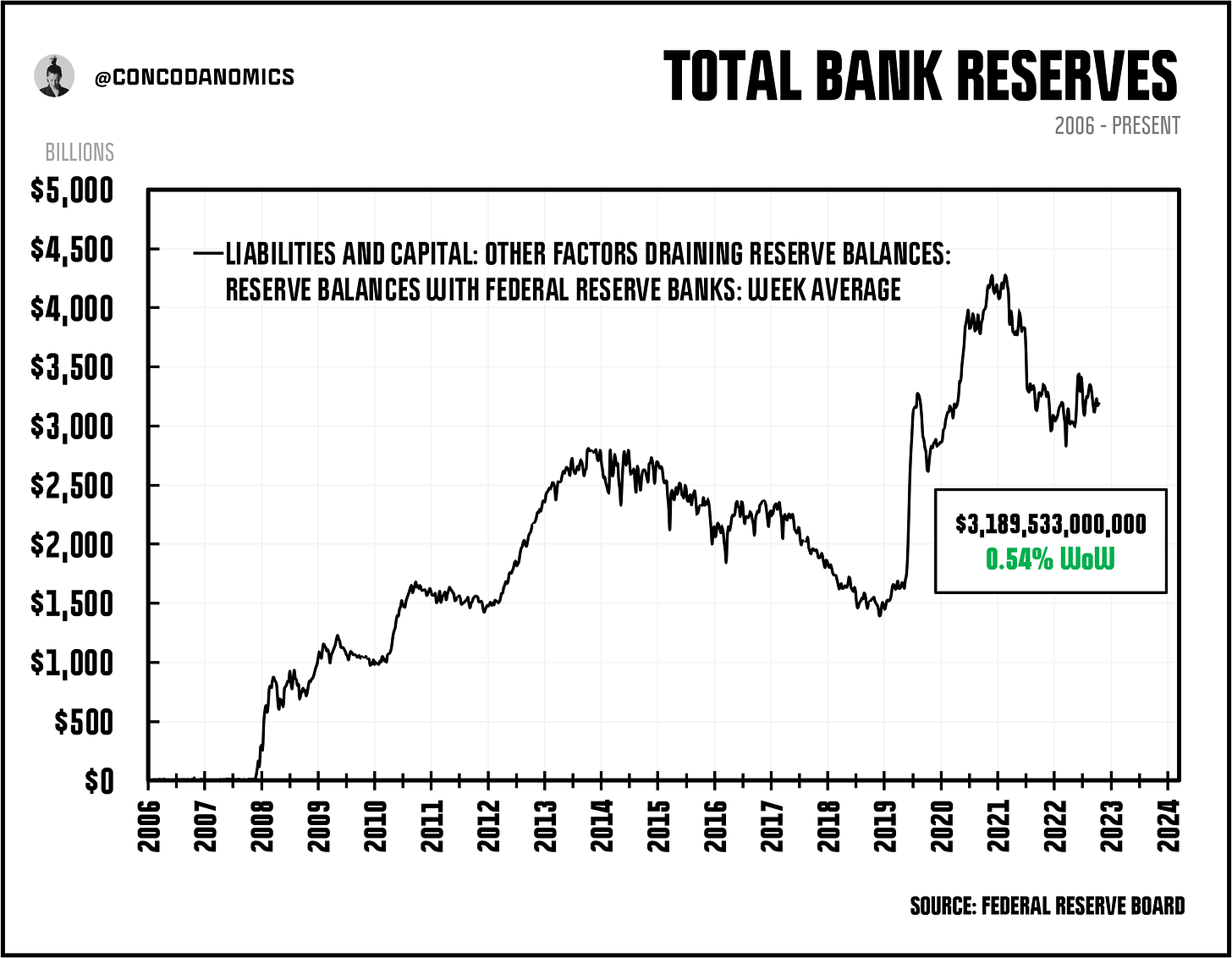

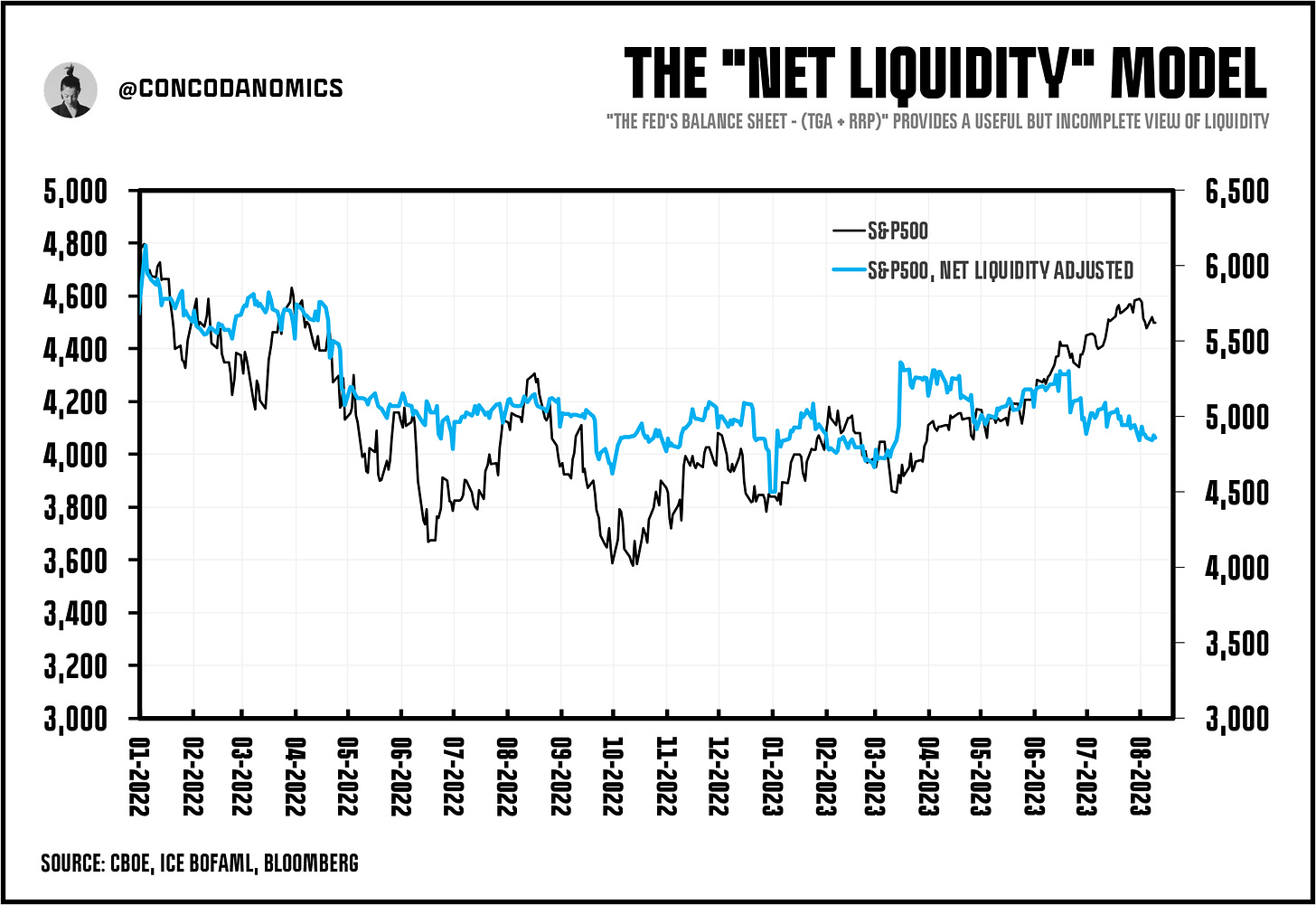

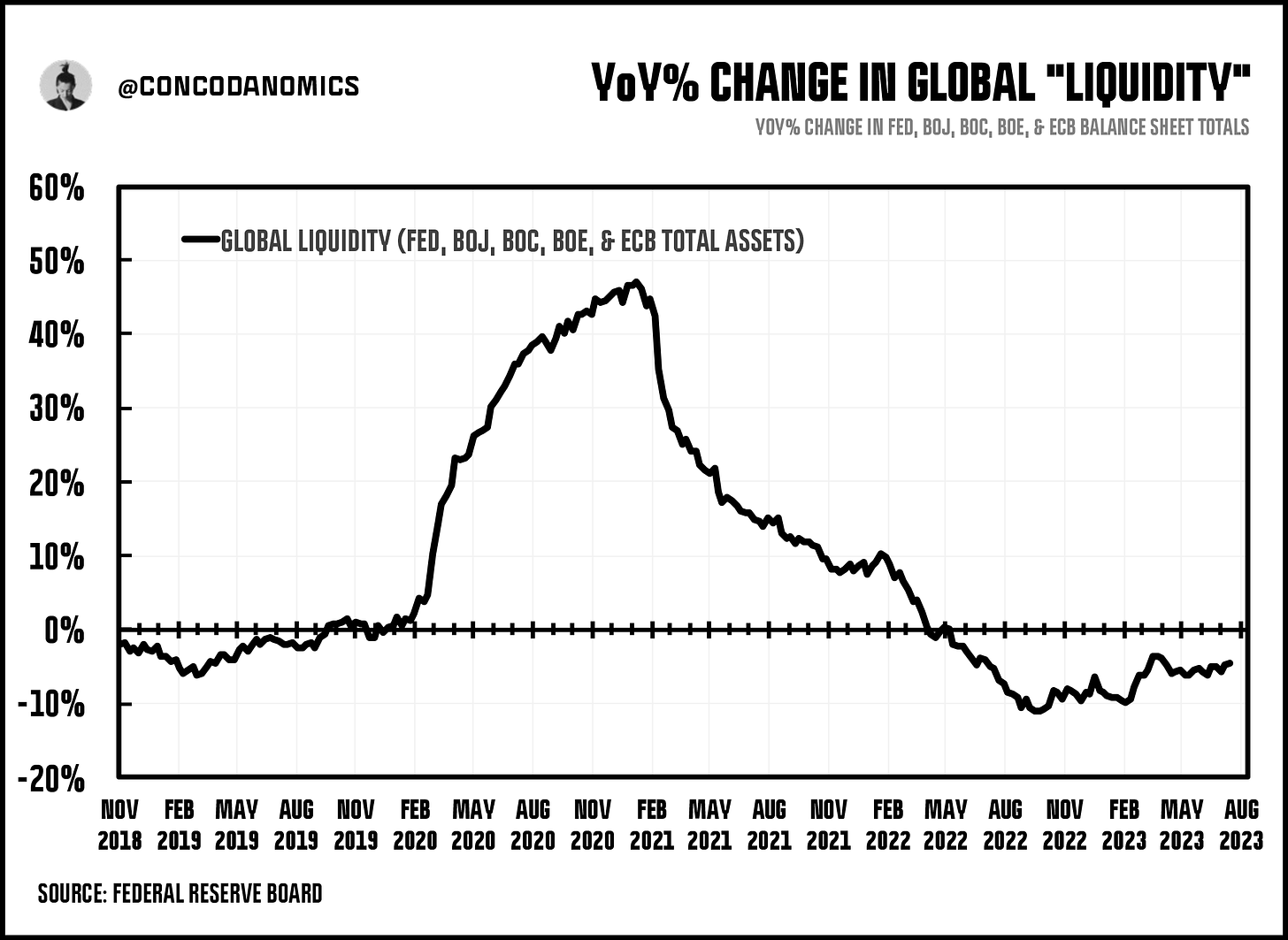

Markets frontrun the effects of a stronger, more potent QT. With notes/bonds issuance increasing, risk assets won't rise as smoothly and easily as before. Liquidity indicators have responded in kind

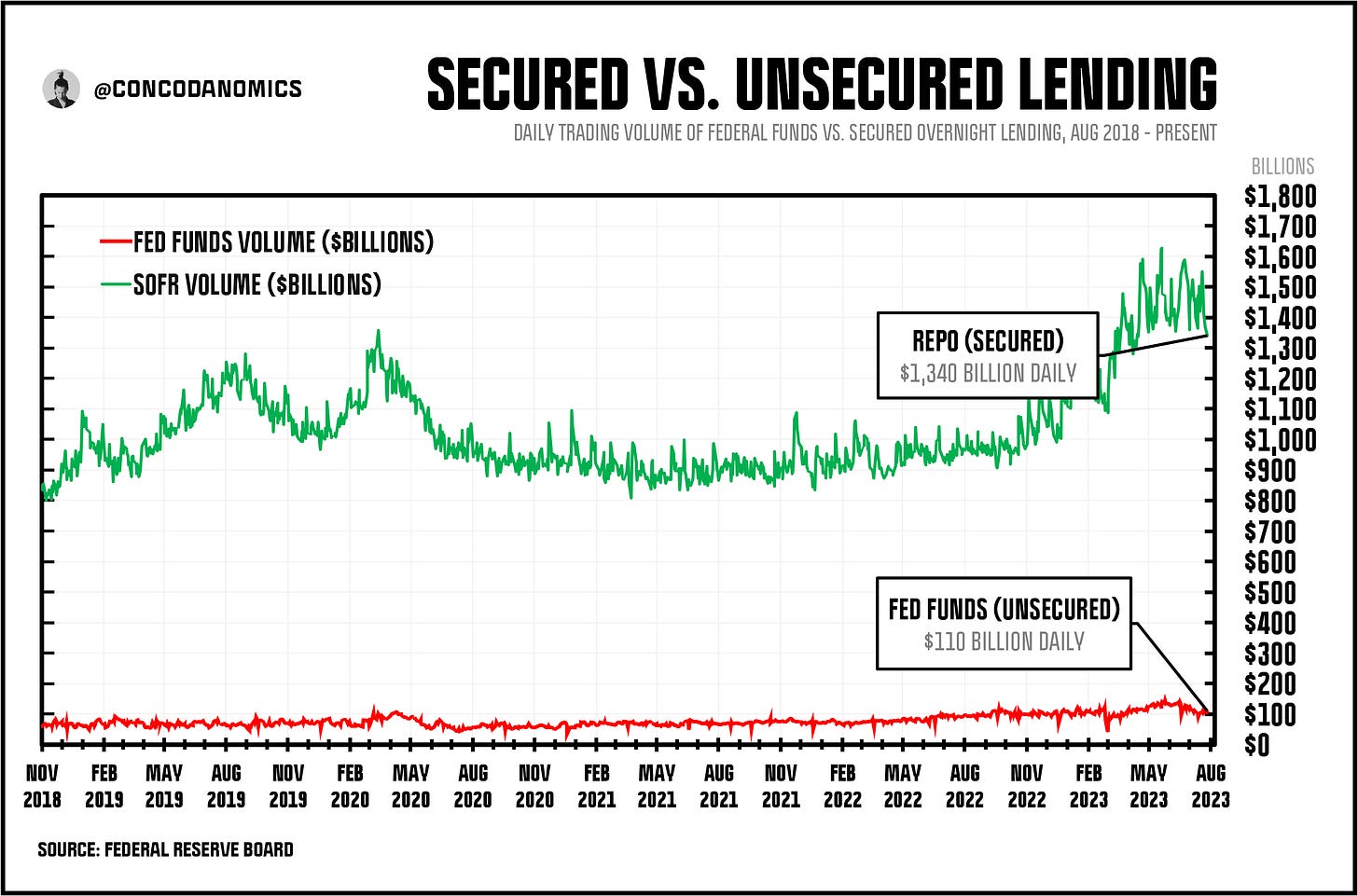

In case you missed it — or you’ve just joined us — the latest of our primers, The Death of the Interbank Market, went live earlier yesterday:

In our next subscriber primer, we’ll dive deep into the world of dealers, the major plumbers of the financial system. In our forthcoming article, however, we’ll be discussing the mechanics of the U.S. Treasury’s latest actions (Tighter Quantitative Tightening) and how these create a headwind for risk assets.

But first, a money market brief…

Neophyte question: Can the resumption of student loan payments be viewed as a mini QT? Thanks for the hard work ninja.

That which doesn’t kill us will make us stronger.