Money Market Brief

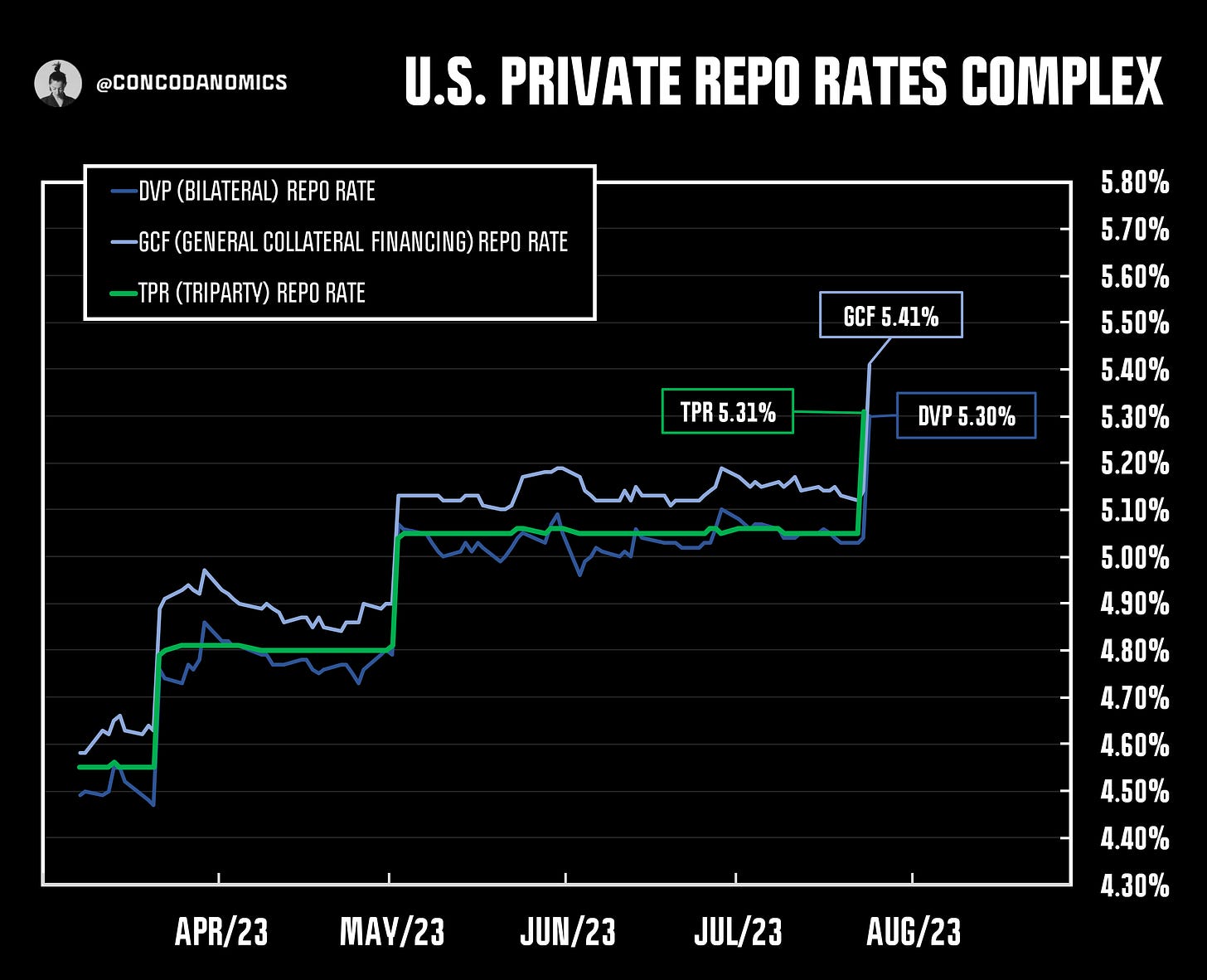

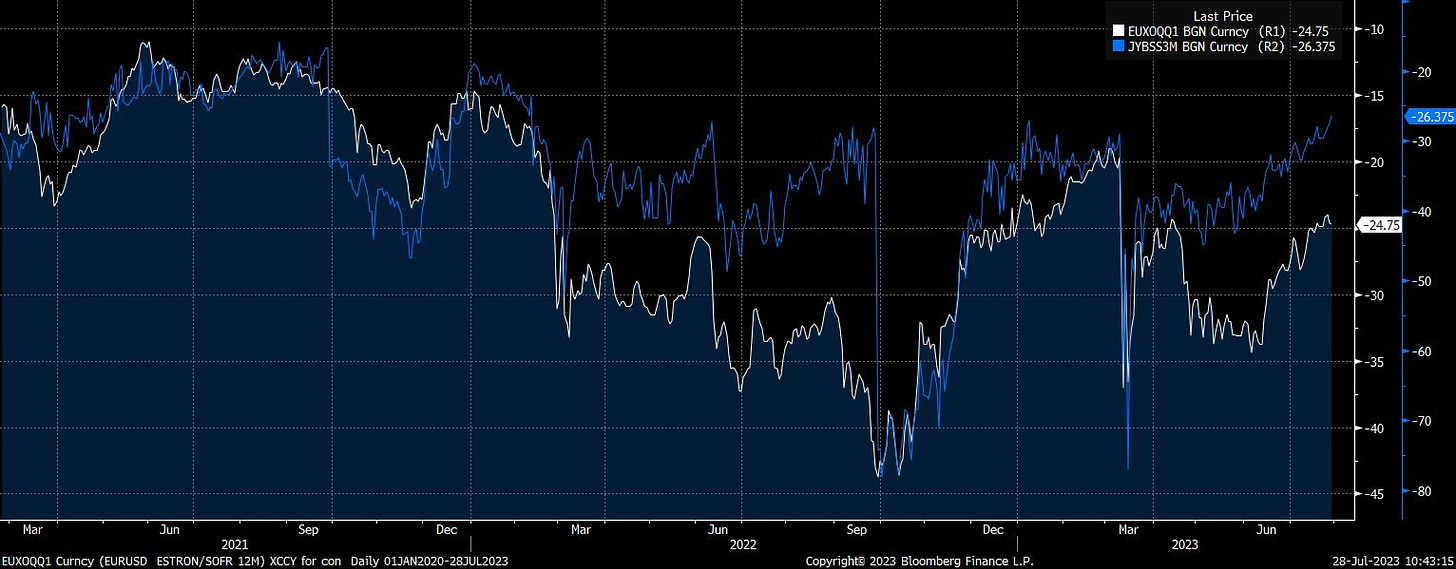

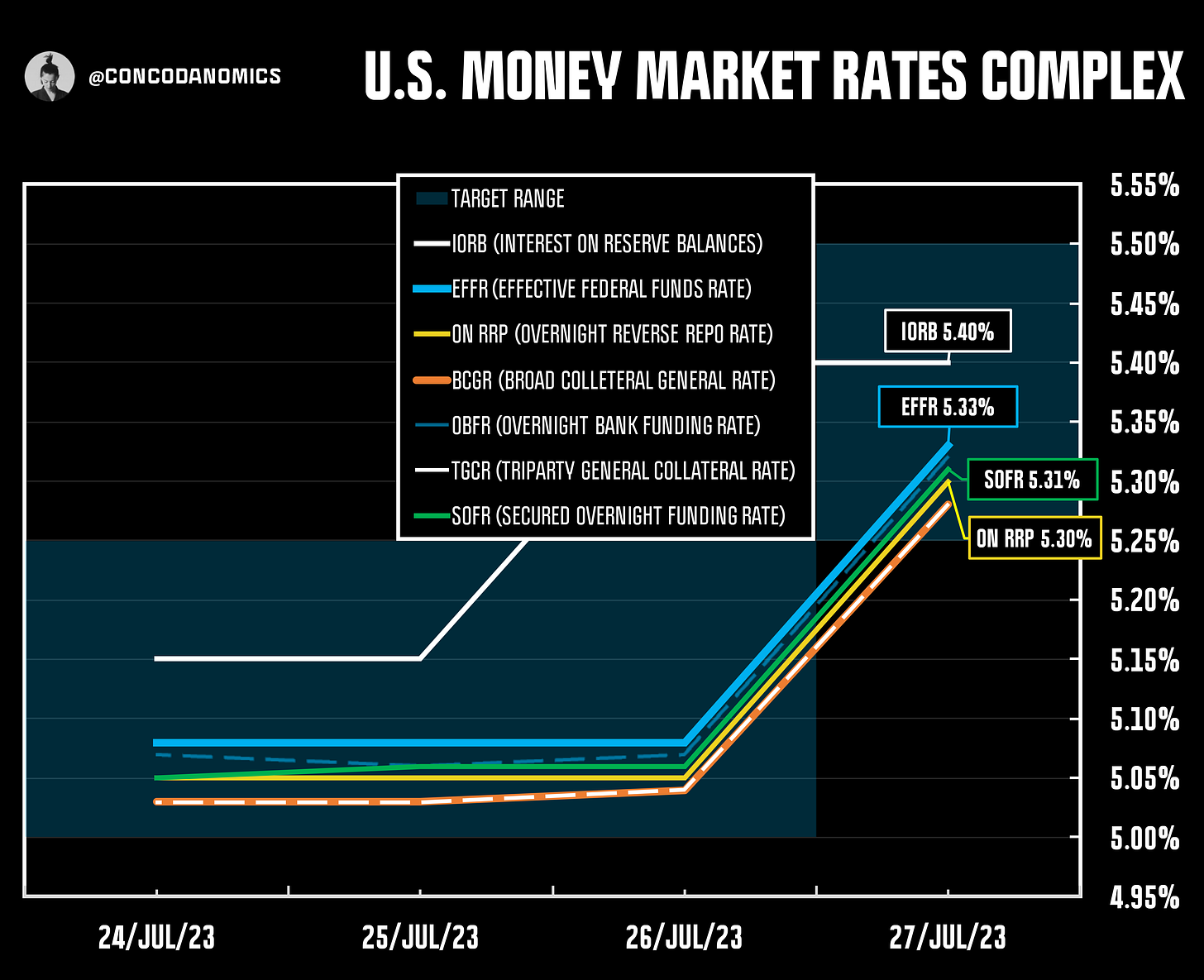

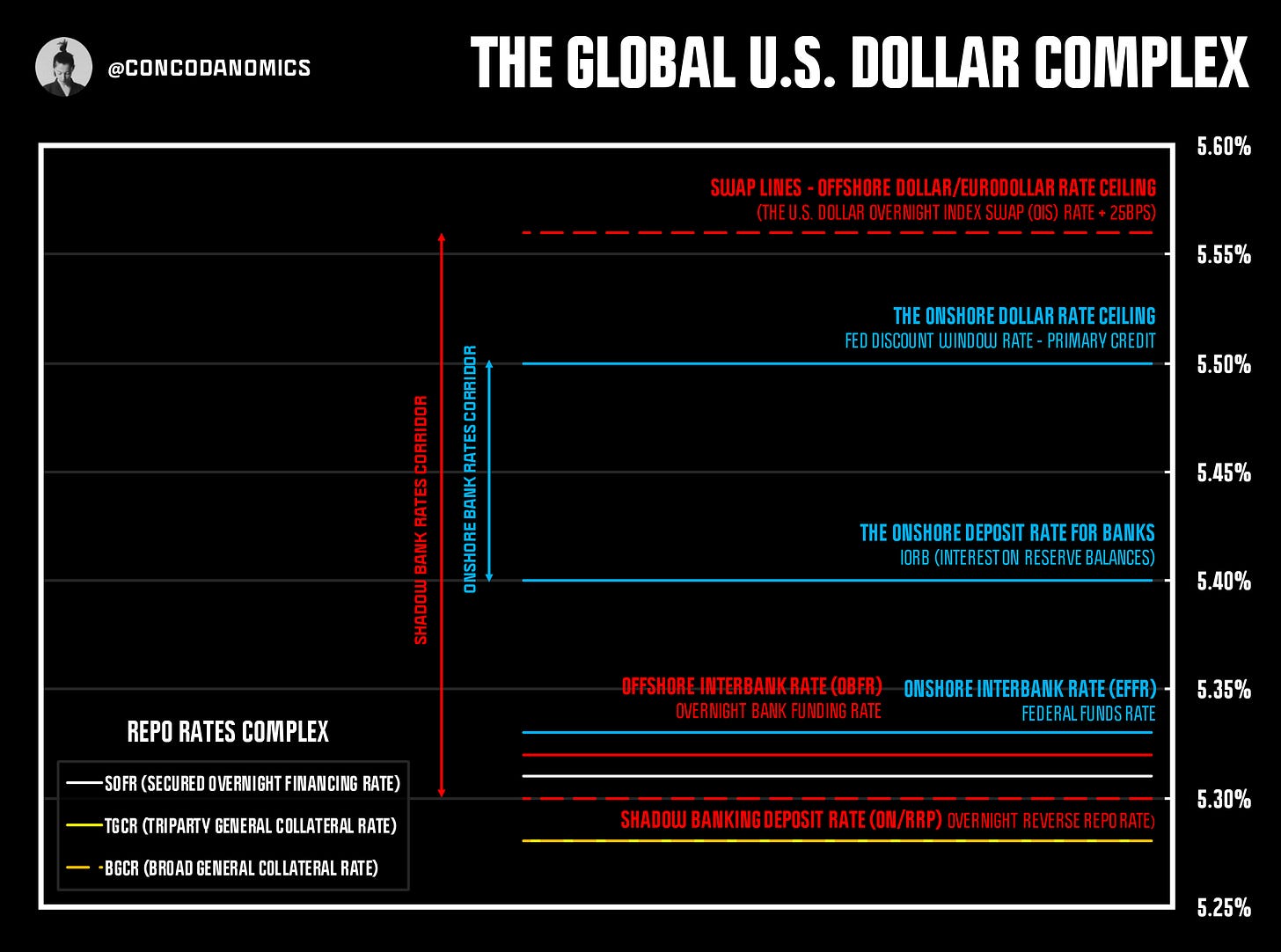

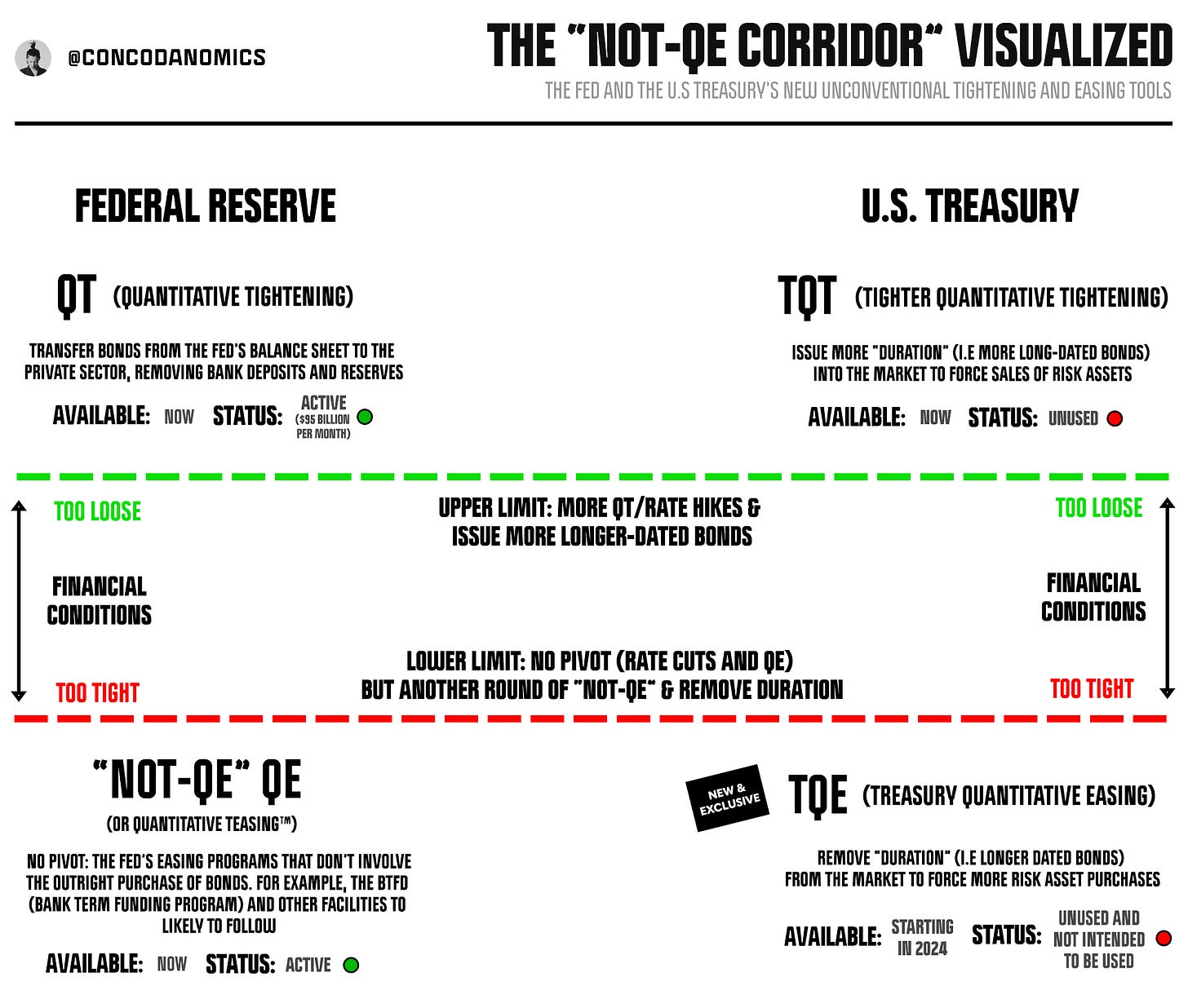

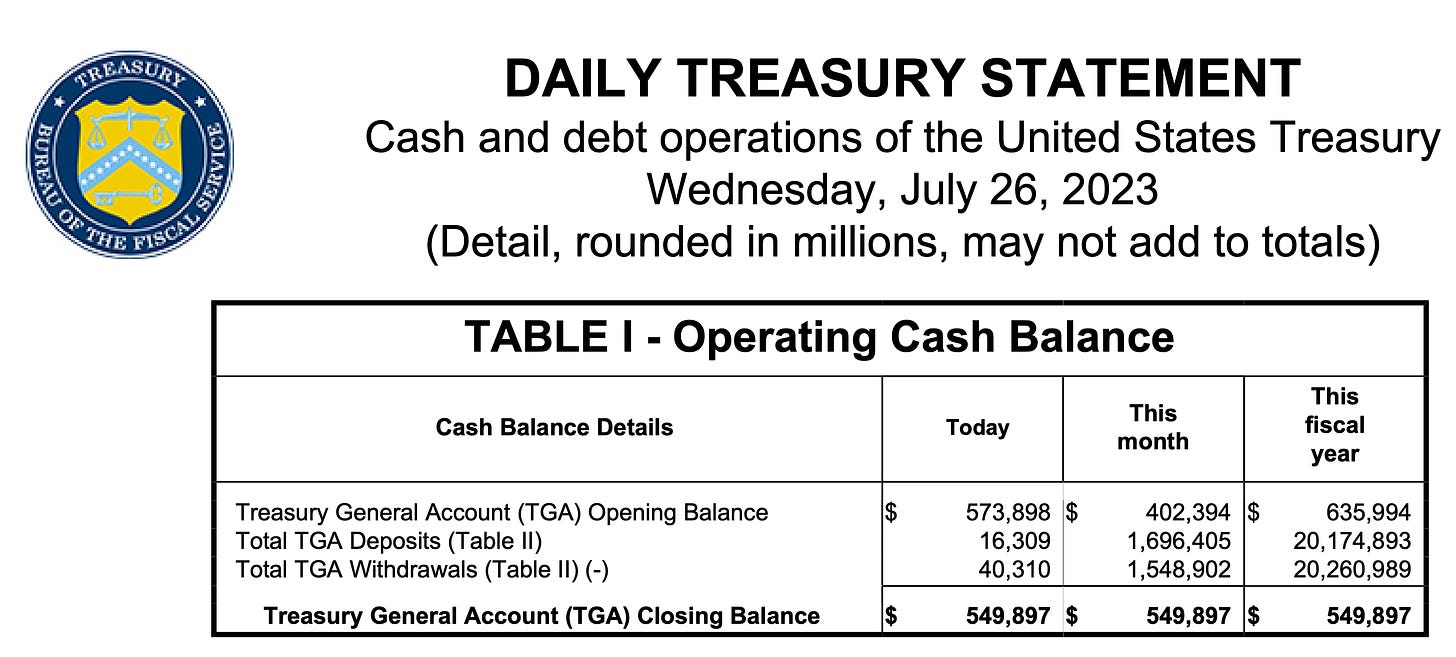

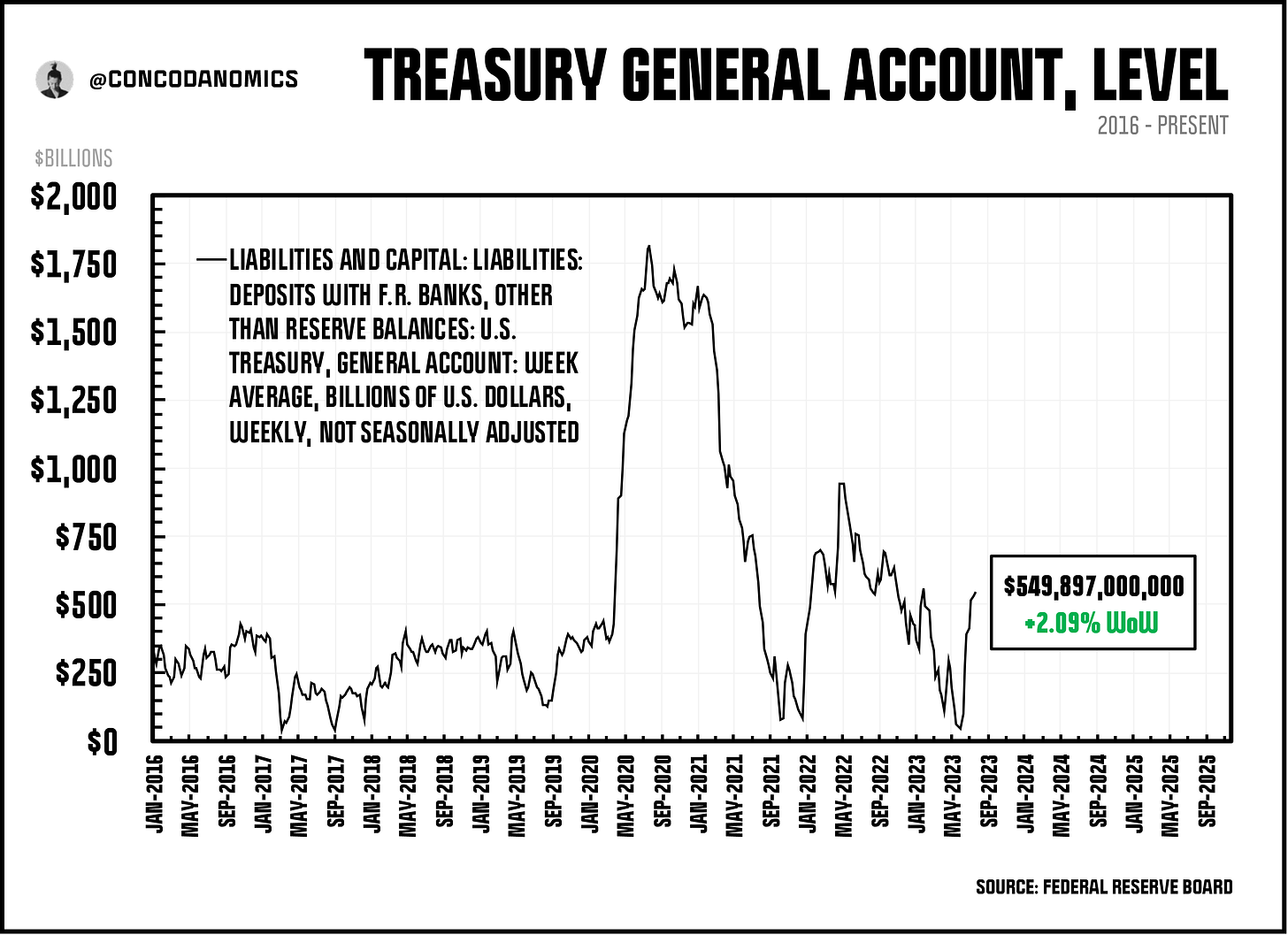

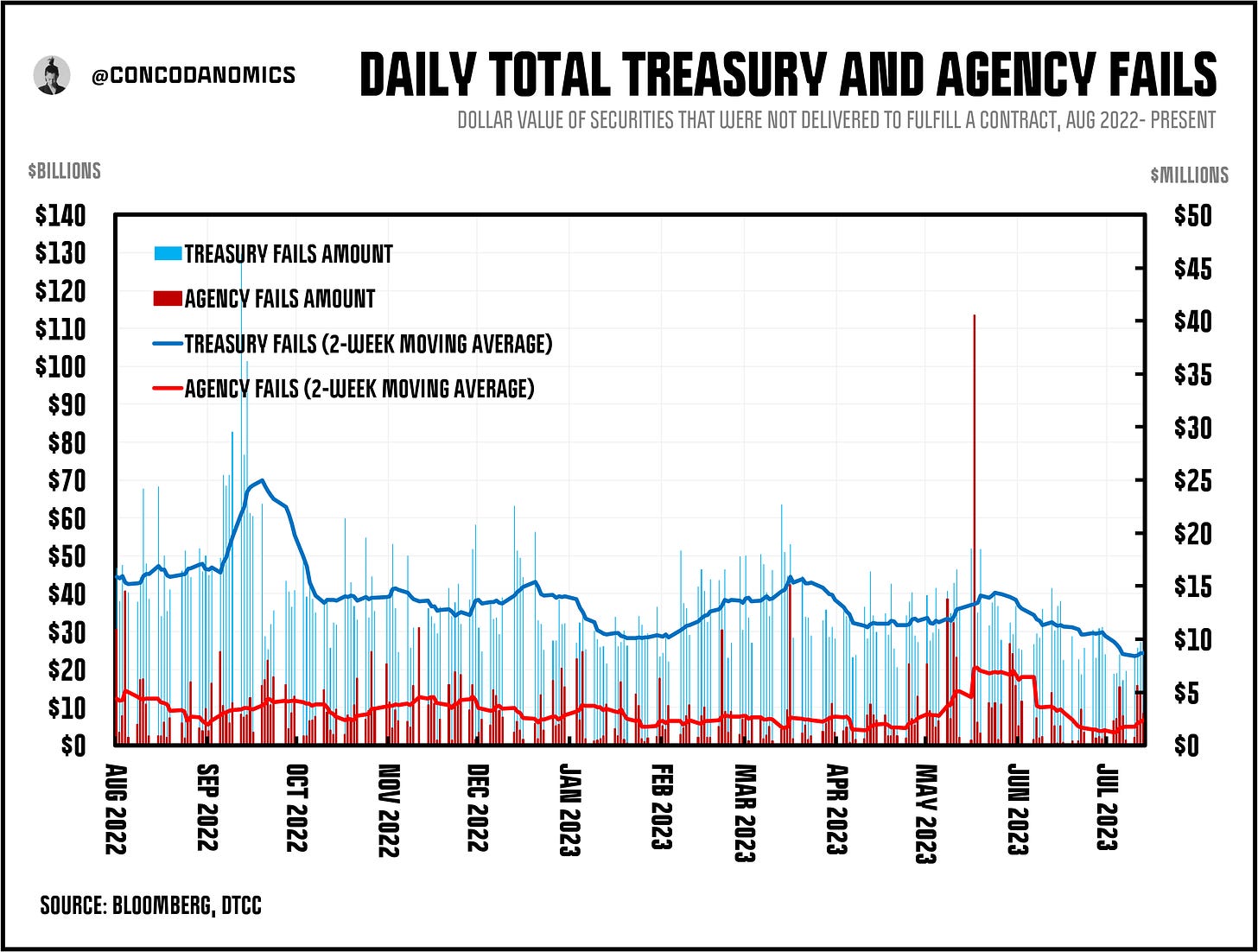

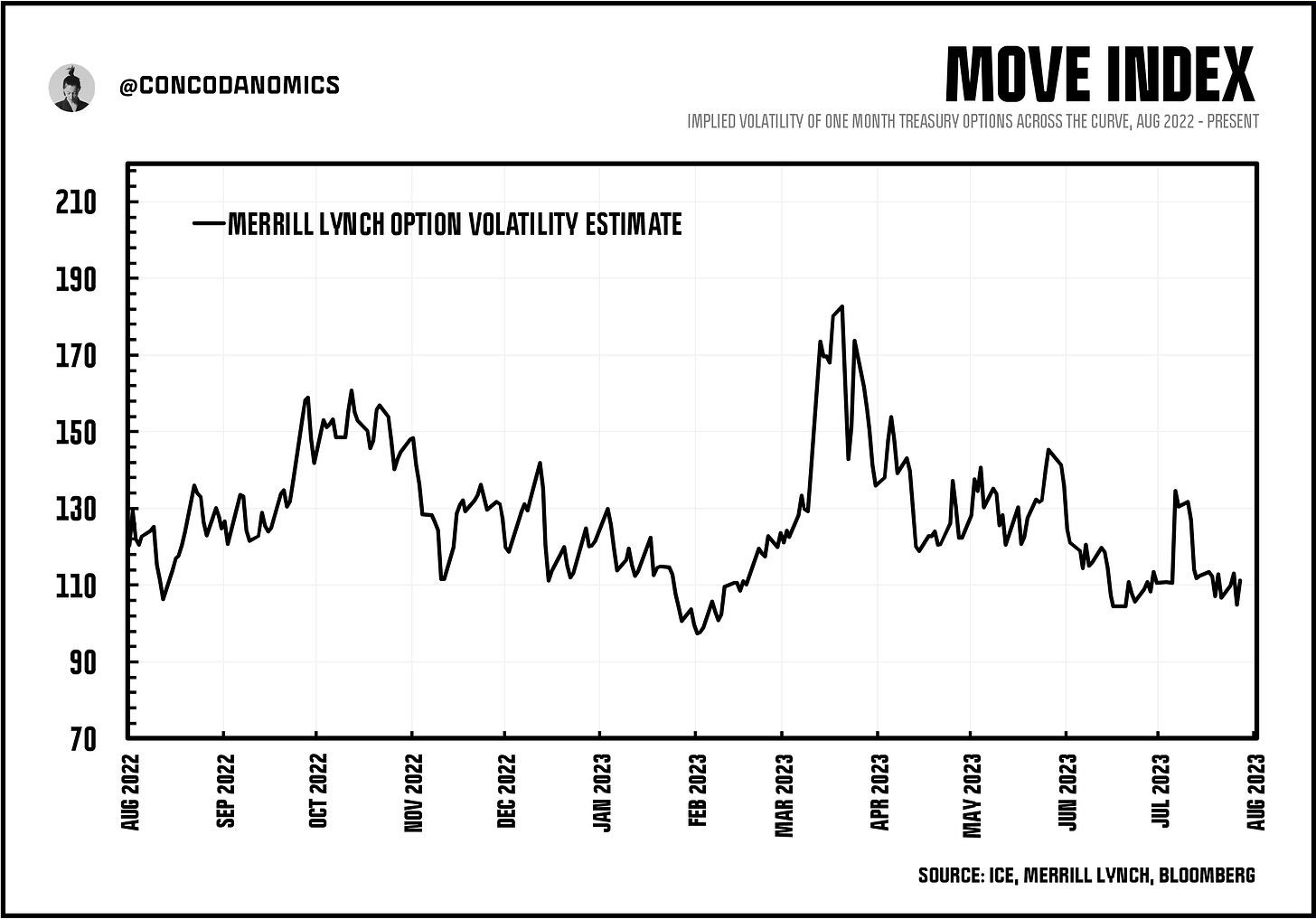

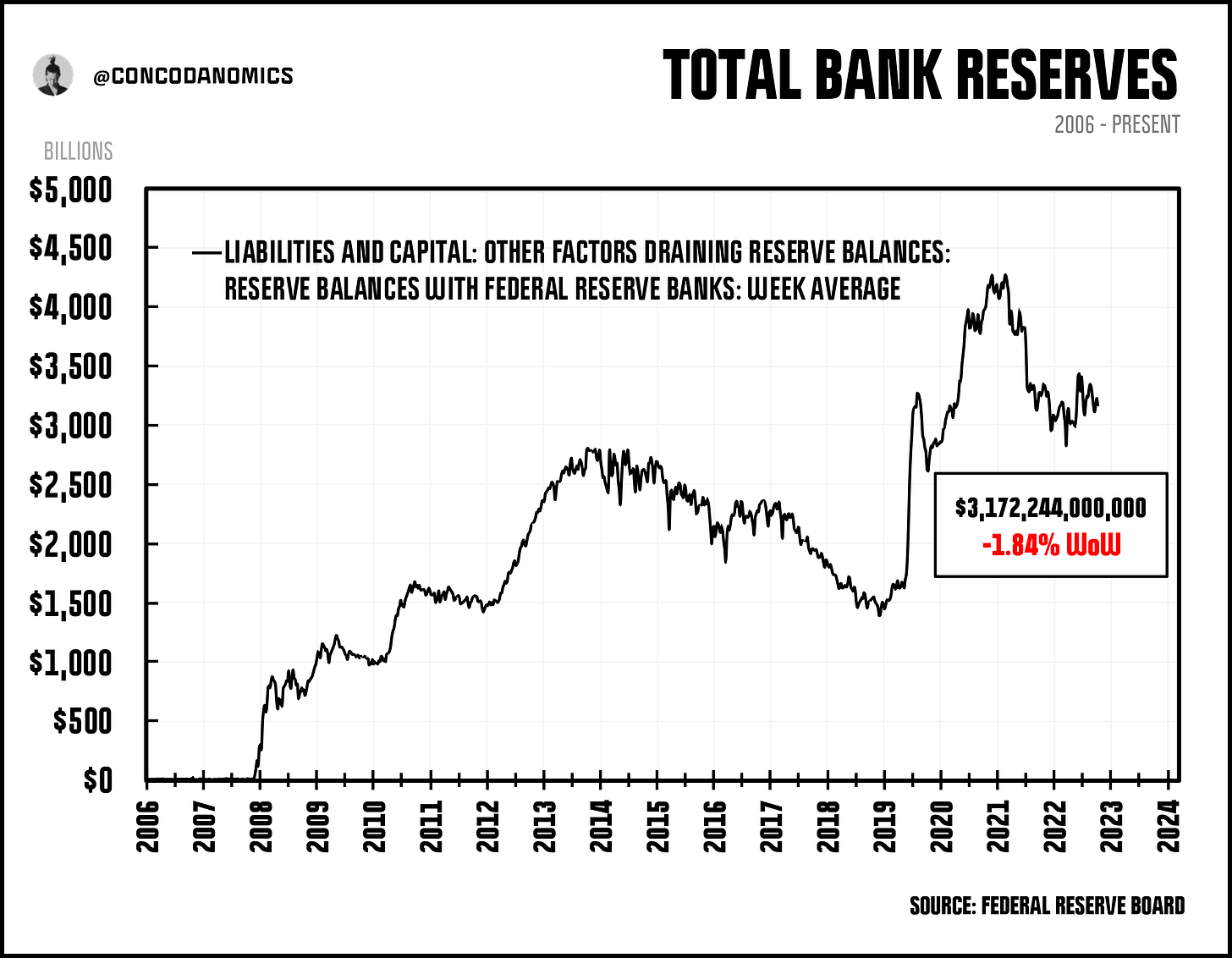

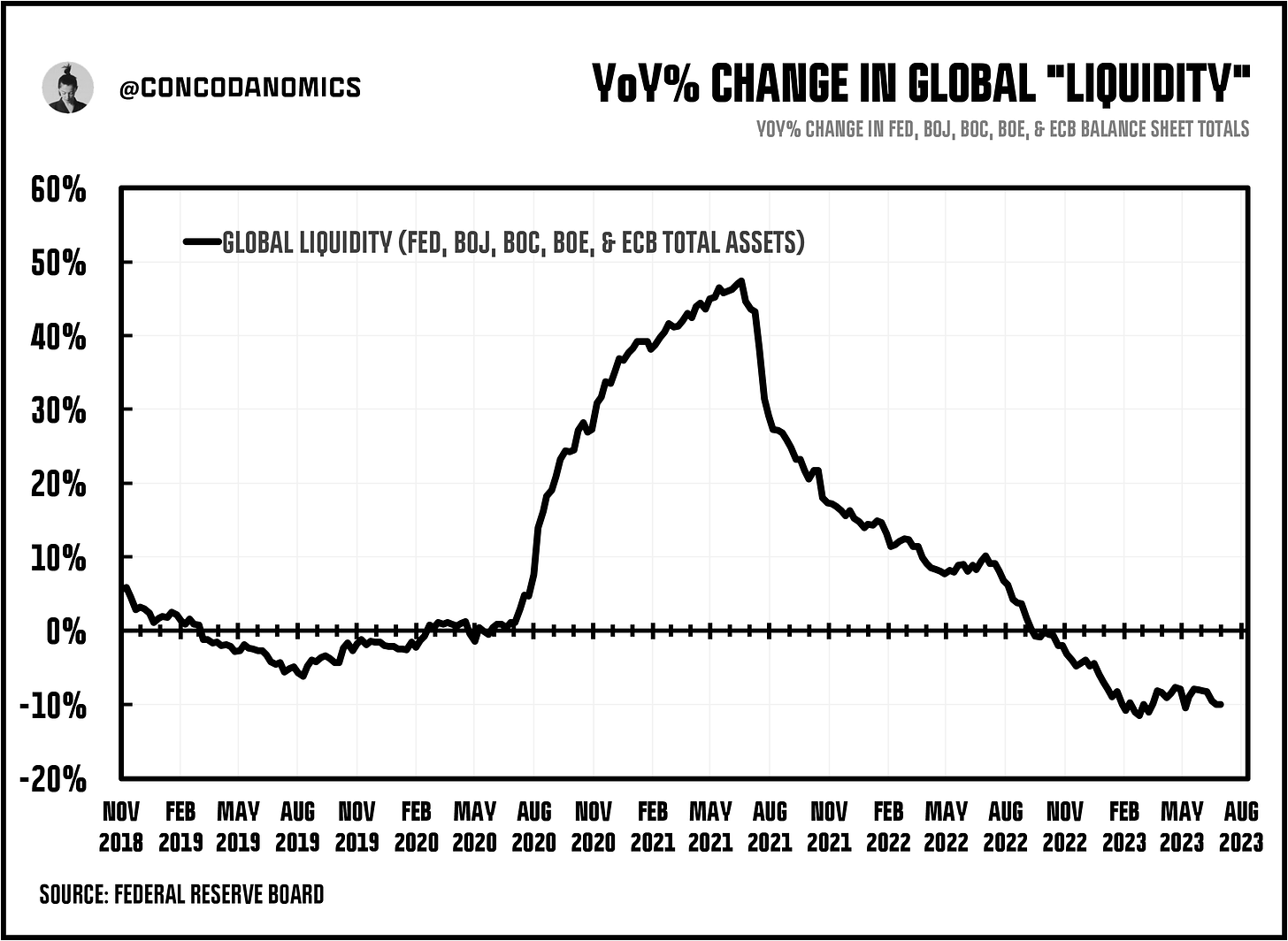

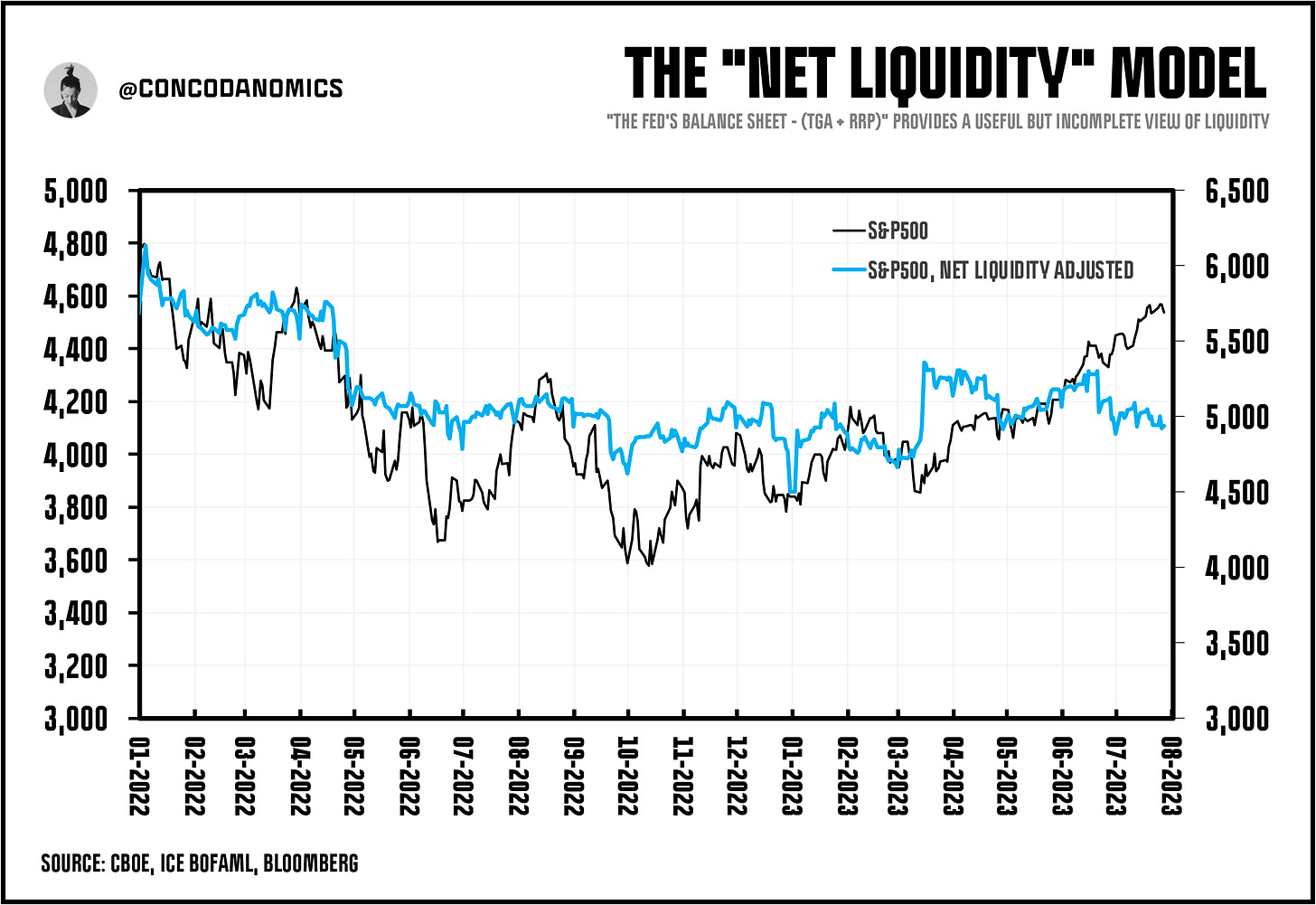

while "net liquidity" detaches from stocks, other liquidity measures (treasury fails, cross-currency bases, MOVE index, etc.) point to expansion. QT & falling reserves aren't enough to tame the beast

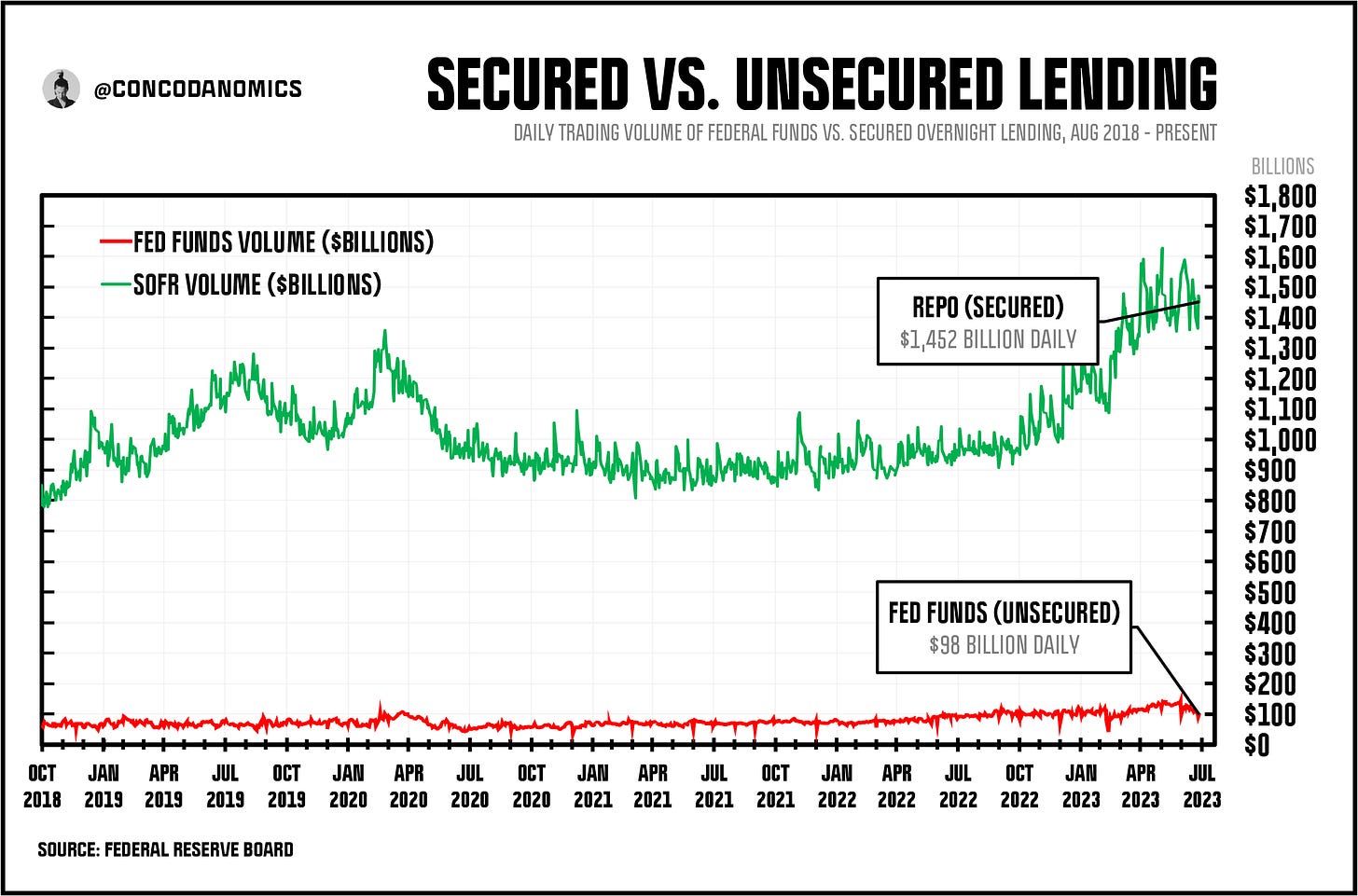

In case you missed it — or you’ve just joined us — our latest piece, the Repo Market Blindspot, went live earlier this week:

In our next subscriber piece, we’ll look at the history and the slow demise of what used to be a key market: the market for Fed Funds (bank reserves), plus what the future holds. But first, a money market brief…

Hee Concoda! I've noticed that I can't find your older pre-market sentiment articles anymore. Do you have plans to publish them again in the future or add the old ones back? I enjoyed reading those articles, and I find them really useful in helping me keep order in the chaos of the market :) Not sure if im asking this question under the right article, but I was hoping you could still address it. Big thanks!

Hey Conks, great read as usual. What do you make of the tightening in cross currency basis in your last chart? My initial read is that cash for the TGA rebuild is coming out of RRP instead of bank reserves and that liquidity generally looks plentiful when looking at repo market rates. Love to hear your thoughts.