The Stealth Liquidity Squeeze

U.S. Treasury officials have reluctantly deployed covert tightening

After easing financial conditions via a series of covert actions, monetary leaders can no longer pretend to tighten. The dark side of Quantitative Tightening (QT) has been unleashed, not by the Fed itself, but by the U.S. Treasury. The Stealth Liquidity Squeeze™ is here.

In early winter at the start of 2022, the Federal Reserve announced it was undertaking the monumental task of unwinding its $9 trillion balance sheet. The U.S. central bank’s second Quantitative Tightening (QT) program had officially commenced. This coincided with the Fed’s full-blown tightening cycle, including sharp rate hikes that shook markets globally. Anticipating peak liquidity and growth, plus the death of the “inflation is transitory” narrative, risk assets — once powered by a huge speculative frenzy — sold off sharply. Subsequently, the idea that QT was a major drag on asset prices had been cemented.

As months and quarters passed, however, QT took a backseat. Slowing growth and intense rate hikes were blamed as the primary causes behind the popping of the greatest market mania on record. The Federal Reserve’s “inflation rug pull” had resulted in a slow, protracted 45% decline in equities, a once-in-a-lifetime selloff in government bonds, and the collapse of many crypto empires. Despite the decline, the stability of the system persisted, but only until September 2022.

The near-failure of U.K’s bond market and the following intervention by the Bank of England marked the bottom for global liquidity. Still, whether intentional or not, monetary authorities globally, but especially the Fed and U.S. Treasury, maintained a tightening stance publicly. Yet behind the scenes, they continued to supply enough liquidity to stave off any crisis. After multiple episodes, from a banking panic to a debt ceiling fiasco, they unofficially gave up on enforcing any meaningful tightening. “Stealth QE” was the new policy.

As 2023 arrived, the debt ceiling quarrel forced the U.S. Treasury to draw down almost its entire bank balance in the TGA (Treasury General Account), pushing reserves back into the system, thus once again offsetting QT’s ability to hinder liquidity. What’s more, the U.S. Treasury continued to issue only short-term government debt, further hindering QT’s impact to quash risk sentiment. Even after the Silicon Valley Bank collapse emerged, the U.S. government’s bailout of depositors and regional bank rescue programs only further reinforced the idea that monetary leaders were willing to do anything to ease financial conditions, still without an official pivot. By implementing the BTFP (Bank Term Funding Program), the Fed signaled to the market that they were willing to remove as much interest rate risk as needed. Bond volatility decreased rapidly, which rippled into credit and other risk assets, juicing markets further. With liquidity sustained, the U.S. economy grew more resilient than most economists had expected.

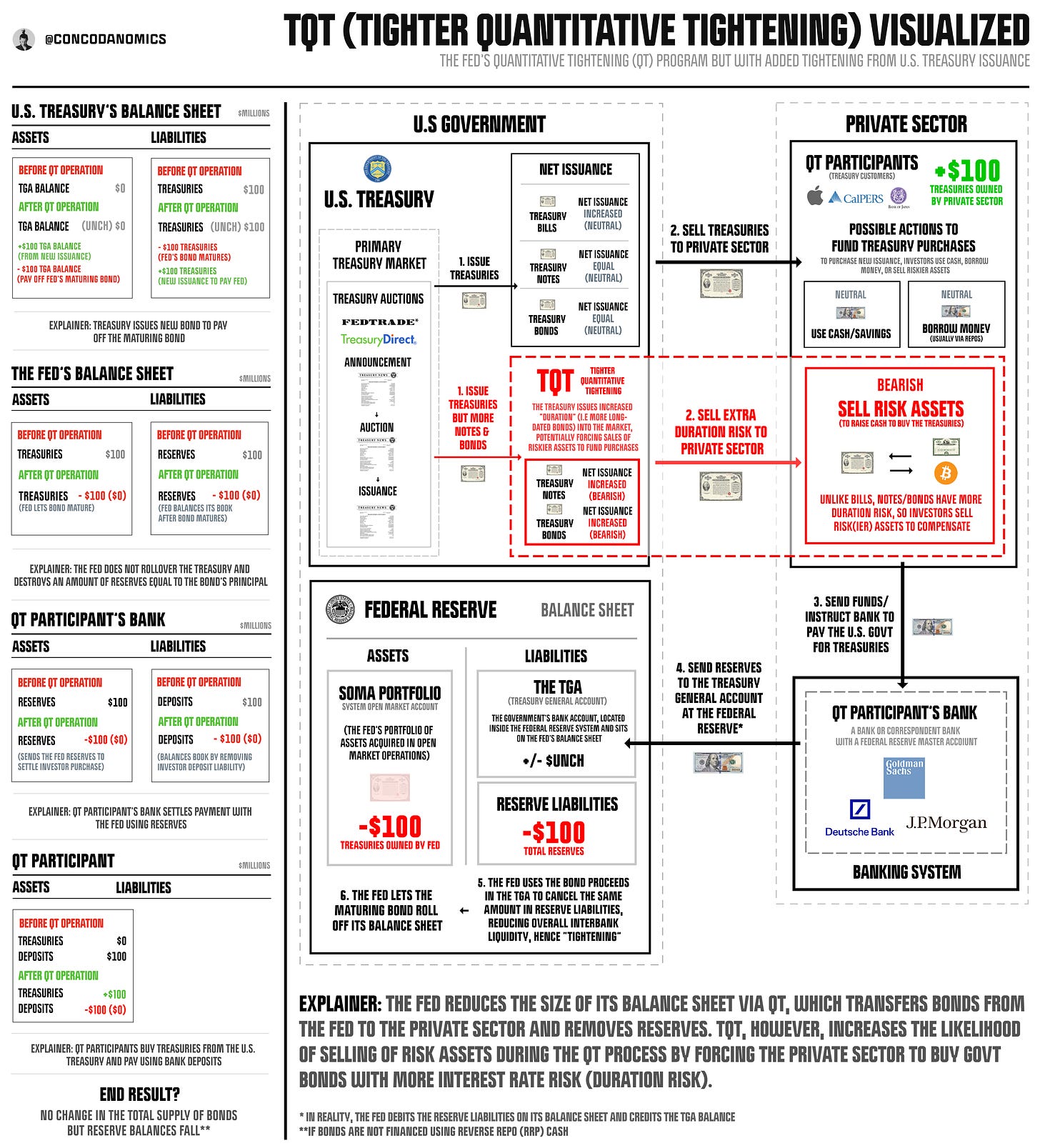

Fast forward to today, liquidity has remained so abundant that even the resolution of the debt ceiling and the ensuing “TGA refill” have failed to subdue risk asset prices. But the tide is now turning. After a series of false alarms, the Fed’s QT has begun to dampen risk appetite. With Janet Yellen issuing a sea of riskier bonds into the market, it’s the U.S. Treasury’s latest actions, not the Fed’s, that have begun to impair risk assets. TQT (Tighter Quantitative Tightening) has been activated, unleashing a stealth tightening effect on markets that most liquidity indicators won’t detect. What does that mean in practice? It’s time to go deeper into the mechanics.

With normal QT (quantitative tightening), the U.S. government reduces the Fed’s balance sheet by a set amount every month, presently $95 billion, by selling new Treasuries to the private sector and using the proceeds to pay off maturing bonds on the Fed’s balance sheet. The U.S. central bank lets the bonds mature off its books while also destroying the same amount in bank reserves. The end result is not a decrease in the number of bonds but a loss of reserves and deposits, thus reducing “liquidity” in the banking system.

Even so, the Fed does not possess the most effective QT weapon. In past episodes, the Fed’s QT alone failed to bring down asset prices, exposing an inconvenient truth: The U.S. Treasury and its officials have always dictated the tightening impact of QT, not the Federal Reserve. When the U.S. Treasury chooses to issue a large number of bills, markets absorb the supply with ease, no matter how abundant. Because the yield on short-term Treasuries equals the risk-free rate, market participants are taking on zero additional risk, and thus don’t need to adjust their risk profile by selling riskier assets to compensate.

But now that TQT has commenced, U.S. Treasury Sec. Janet Yellen has increased the tenacity of QT by releasing more Treasury notes and bonds, securities with longer maturities and more duration risk, into the market. When participants buy these bonds, they will either use cash balances, borrow money, or sell other investments. Since purchasing Treasury bills carries minimal duration risk, market players will most likely use cash or borrow money. But with notes and bonds, it’s different. The added interest rate risk of Treasury notes and bonds forces market players to reassess their risk tolerance, potentially selling riskier assets to counteract the increased risk they are bearing.

Today, the increase in net issuance of notes and bonds, hence duration risk, remains minimal. But markets are forward-looking. Ever since the Treasury announced huge increases in “coupon issuance,” jargon for issuing Treasury notes and bonds, in the coming quarters, market participants have been frontrunning the impact of TQT, by selling risk assets at the fastest pace this year. The U.S. Treasury is set to increase bonds with added duration risk by ~$185 billion in Q3, rising to ~$339 billion in Q4.

Despite all this, we’re told that the Fed holds all the cards when it comes to tightening financial conditions, and that the U.S. Treasury is a completely independent entity. Yet both have tried, indirectly and covertly, to boost liquidity while reiterating a tightening stance on the surface. Now, though, they have reached their limitations. The world demands that U.S. monetary officials issue riskier bonds into the market. QT is gradually turning into TQT, allowing quantitative tightening to possess enough power to curb risk appetite. Finally, after almost a year of muted impact on liquidity and sentiment, the monetary plumbing has produced a genuine bearish catalyst.

But while the economy remains resilient, the job market remains tight, and the Fed’s rate hikes fail to have their desired outcome, TQT alone won’t be enough to slay the stock market’s natural tendency to rally further. Risk assets won’t rise as smoothly and easily as before. Still, it will likely take more disorder to terminate the rip-roaring rally in risk assets we’ve witnessed so far this year. Since markets have already front-ran the effects of a stronger, more potent QT, something else has to give.

Minus TQT, most monetary leaders’ stealth easing programs remain in effect, while economic resilience and adequate liquidity have persisted longer than most have anticipated. If this continues, markets may only transition into a choppy period, not a serious correction. As other asset classes continue on their present trajectory, risk assets are likely to experience mild turbulence. The Great Chop™, as it will come to be known, is here, and it’s only starting to take shape.

Next up: demystifying dealers, the monetary plumbers of the financial system…

If you liked this, feel free to hit the ♡ button to let us know and share a link via social media to help us grow. Comments are also encouraged. Thanks for being a Concoda Subscriber!

Thanks, Concoda. Until I started reading your stuff, I never realized how completely clueless I was about absolutely everything. Now at least I understand what a complete imbecile I am.

Will the great chop be like the yacht scene in Wolf of Wall St?

https://www.youtube.com/watch?v=u4ppoDl1K8w