As anticipated in our last brief, the Great Chop™ in equities has continued. Not much to say on that, since our outlook remains the same. But this does give us more time to cover other things. In our latest piece, we unveiled the intricacies of central bank swap lines:

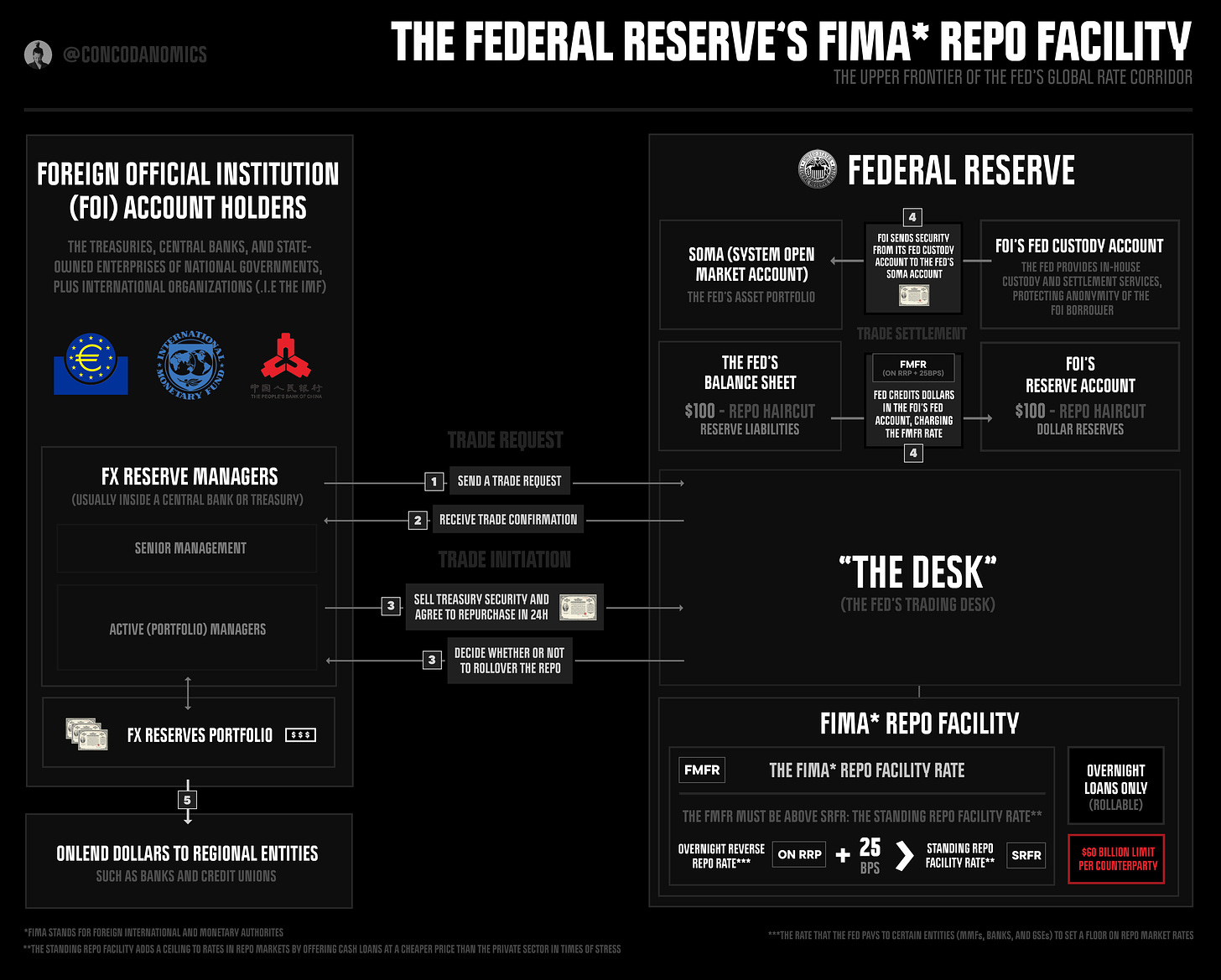

Next, we’ll look at the Federal Reserve’s “final frontier,” the outer limits of its rate hierarchy. Subscribe to get it first (and to support our work, of course)!

But first, a sneak peek, and onto the money market brief…

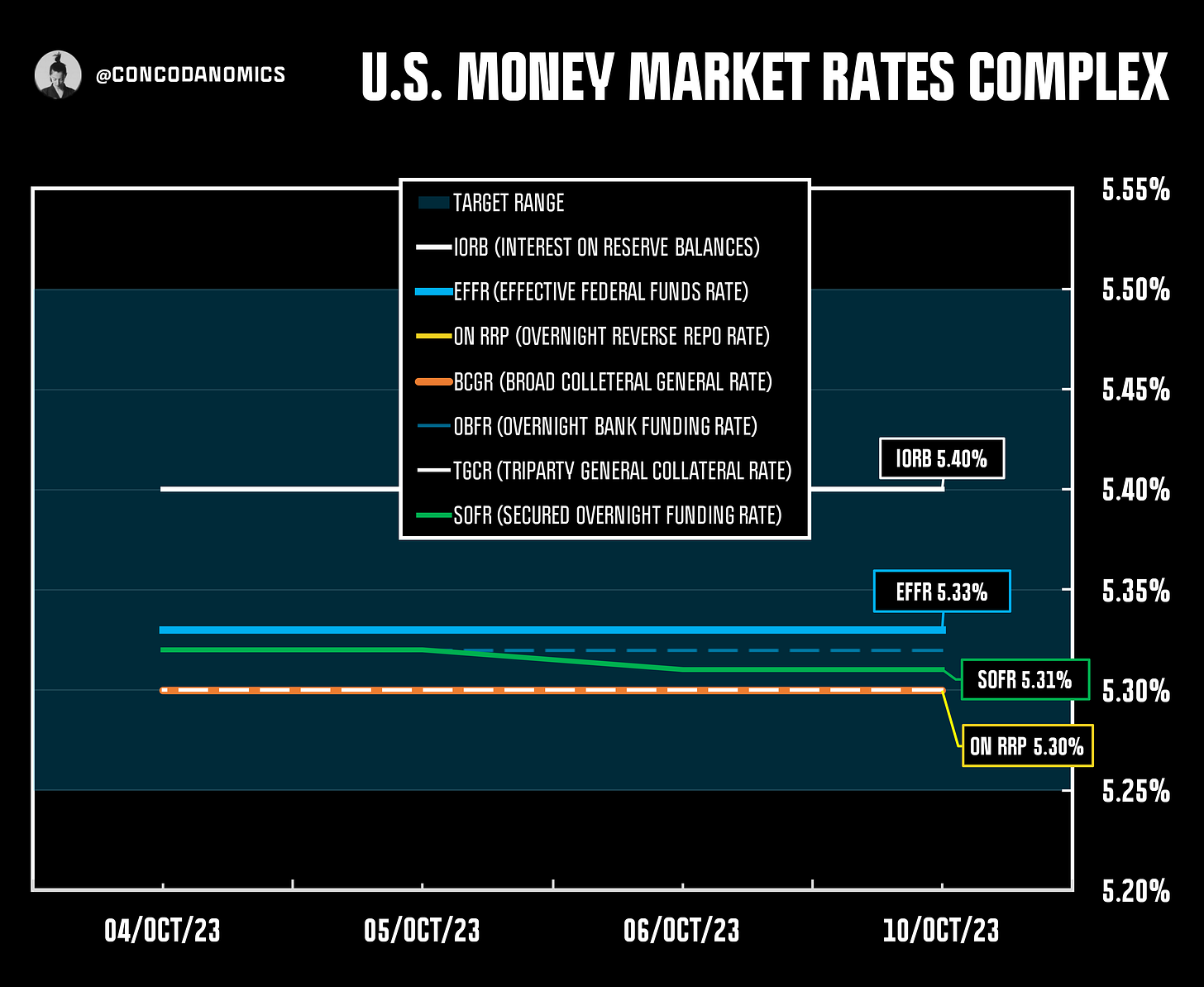

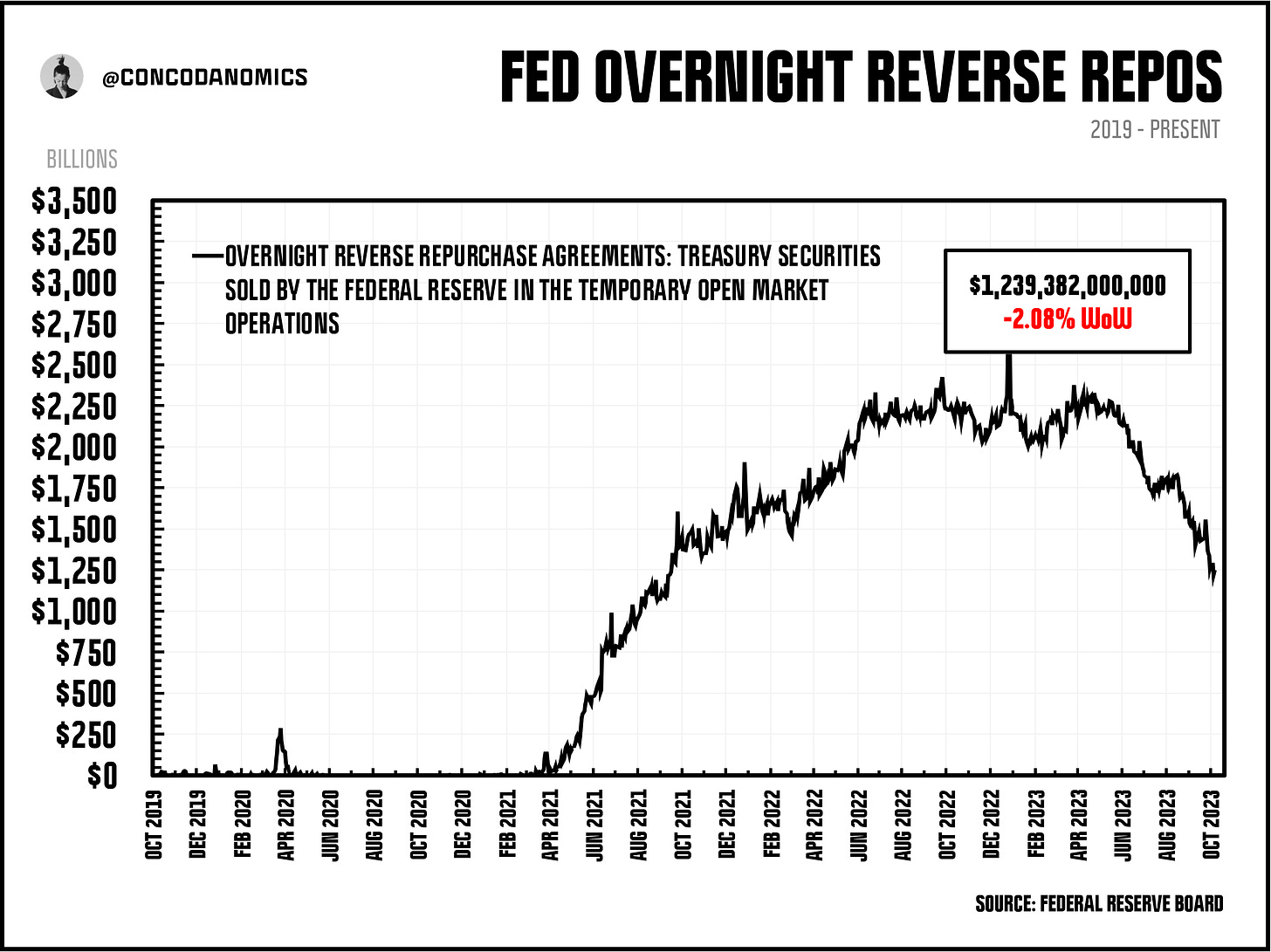

Thanks for all you do. What would drive the RRP down to zero other than the FED dropping the RRP rates much lower? How much of RRP can flow into USTs. My thinking is these funds do not want duration and would only go into Tbills. With Treasury reaching the upper recommended Tbill limit (approx 20%) by the TBAC which should force Treasury to issue more duration, my thinking is there would be a lower limit for RRP (everything else static).